“Combined with Maine’s circuit breaker property tax relief program, which was renamed and converted to a refundable income tax credit two years ago, there will now be substantial financial incentives for low-income Mainers to file an income tax return and receive refundable credits they have coming to them. And that will mean they have more in their wallets to pay the bills or save for the future. “

The tax overhaul agreed upon by legislative leaders in their recent budget negotiations includes several major provisions that affect state and local taxes, including lower income tax rates, a broader income tax base, a doubling of the homestead property tax exemption, an estate tax cut, and permanently higher sales tax rates.

Overall, leaving aside the estate tax cut and continued cuts to revenue sharing, the tax deal is an improvement for Maine’s state and local system. It provides a tax cut for most Mainers, modestly improves the progressivity—or “vertical equity”—of the current tax system, and avoids unnecessary and harmful cuts to state services.

Of particular note for low- and moderate-income Mainers, the tax overhaul includes two refundable income tax credits available only to Mainers with low or moderate levels of income. For example, a family of four earning $35K per year will be eligible for approximately $375 in tax credits after these changes take effect.

First, the legislature took the long overdue step of making the state’s Earned Income Tax Credit (EITC) refundable, meaning low-income working families can receive the full value of the credit regardless of their tax liability. Maine is one of 26 states that has an EITC designed to complement the federal EITC, which has been proven to reduce poverty, promote work, and have long-lasting positive effects for children. Only people who work qualify for the EITC, and design of the credit ensures that the vast majority of the benefits accrue to working families with children.

The problem with Maine’s EITC has been that it is extremely small—only 5% of the value of the federal credit—and not refundable. For example, a Maine family of four earning less than $38K per year does not currently benefit from Maine’s non-refundable EITC.

Under the budget deal expected to become law this week, Maine’s EITC will remain at 5% of the federal credit but it will become refundable. This is an important policy change that will increase after-tax earnings for 100,000 working poor families in Maine by approximately $7 to $9 million per year.

Second, the Sales Tax Fairness Credit (STFC), is an entirely new initiative created to alleviate the impact of sales tax increases on low- and moderate-income Mainers. Lawmakers have rightly recognized that the sales tax increases in the budget deal —permanently setting the general sales tax rate at 5.5%, the tax on restaurant meals at 8%, and the tax on short-term lodging at 9%—disproportionately affect low-income Mainers. The idea for the STFC comes from a 2013 tax reform proposal offered by then Senator Dick Woodbury and the so-called non-partisan “Gang of 11.” Governor LePage included the concept in the budget proposal he released back in January and legislative Democrats included it in their tax proposal as well.

The name of the credit is somewhat misleading since it is tied to sales taxes in name and spirit only. Taxpayers will not have to document purchases to receive the STFC. They only have to file their income tax return and if their income is low enough given their family size and filing status they will automatically qualify for the credit. And since it’s refundable, families will get the full value of the credit regardless of how much tax they owe.

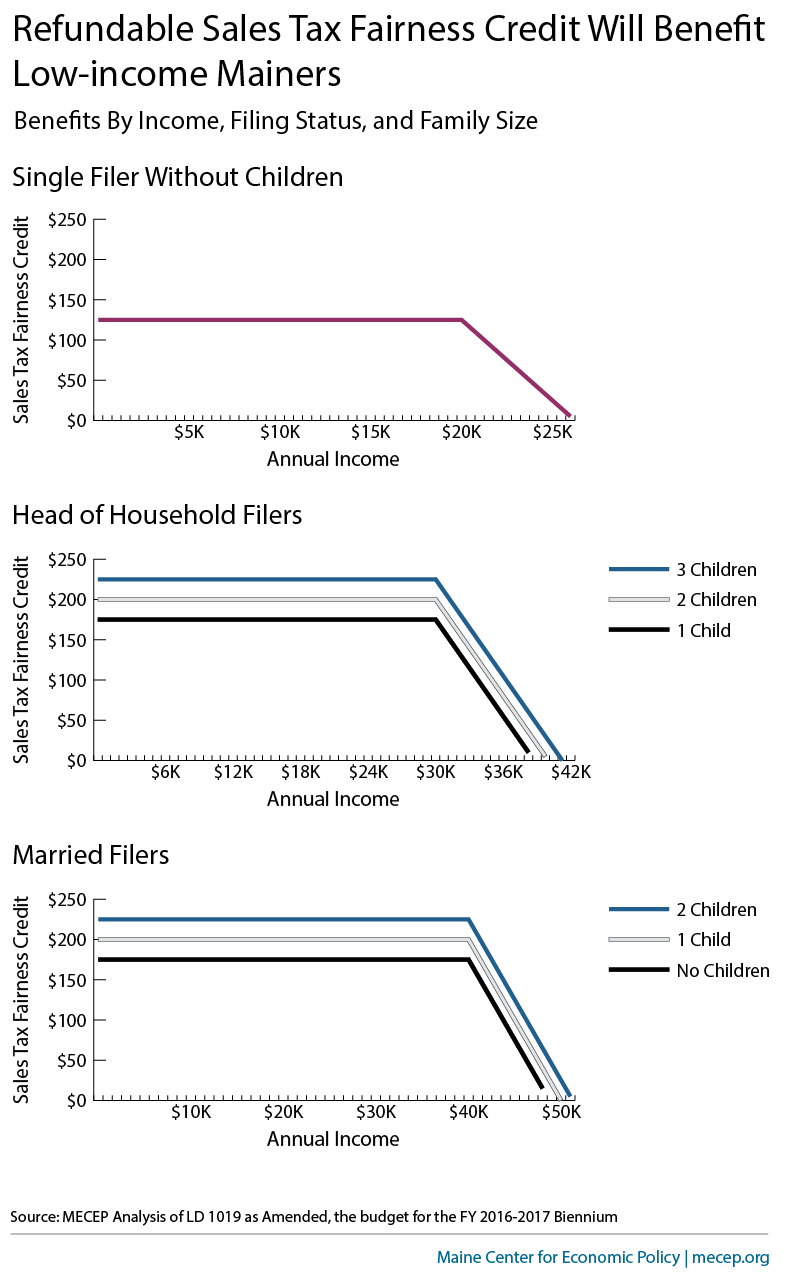

Maine Revenue Services estimates this proposed new credit will provide between $32 and $39 million of targeted tax relief per year when it takes effect starting in tax year 2016. For any given taxpayer, the amount of the credit depends on family income and family size. The maximum credits are shown in the following table:

| Personal Exemptions (Number of People in Family) | Maximum Credit |

| 1 | $125 |

| 2 | 175 |

| 3 | 200 |

| 4 | 225 |

The credit begins to phase out at $20,000 for single filers, $30,000 for head-of-household filers, and $40,000 for Married-Filing-Jointly filers. The following charts show the size of the credit families would receive depending on their income, filing status, and number of people in their family:

Overall, by creating a new, refundable sales tax fairness credit and making Maine’s existing EITC refundable, the new budget will provide more than $40 million in new refundable tax credits to low- and moderate-income Maine families. But there is one hitch: low-income Mainers must file a tax return to claim the credits. Charitable groups that provide free tax preparation services and basic financial advice to low-income Mainers—like AARP and the United Way’s Cash Coalition—will have their work cut out for them to make sure eligible Mainers take advantage of these new refundable credits.

Overall, by creating a new, refundable sales tax fairness credit and making Maine’s existing EITC refundable, the new budget will provide more than $40 million in new refundable tax credits to low- and moderate-income Maine families. But there is one hitch: low-income Mainers must file a tax return to claim the credits. Charitable groups that provide free tax preparation services and basic financial advice to low-income Mainers—like AARP and the United Way’s Cash Coalition—will have their work cut out for them to make sure eligible Mainers take advantage of these new refundable credits.

Combined with Maine’s circuit breaker property tax relief program, which was renamed and converted to a refundable income tax credit two years ago, there will now be substantial financial incentives for low-income Mainers to file an income tax return and receive refundable credits they have coming to them. And that will mean they have more in their wallets to pay the bills or save for the future.