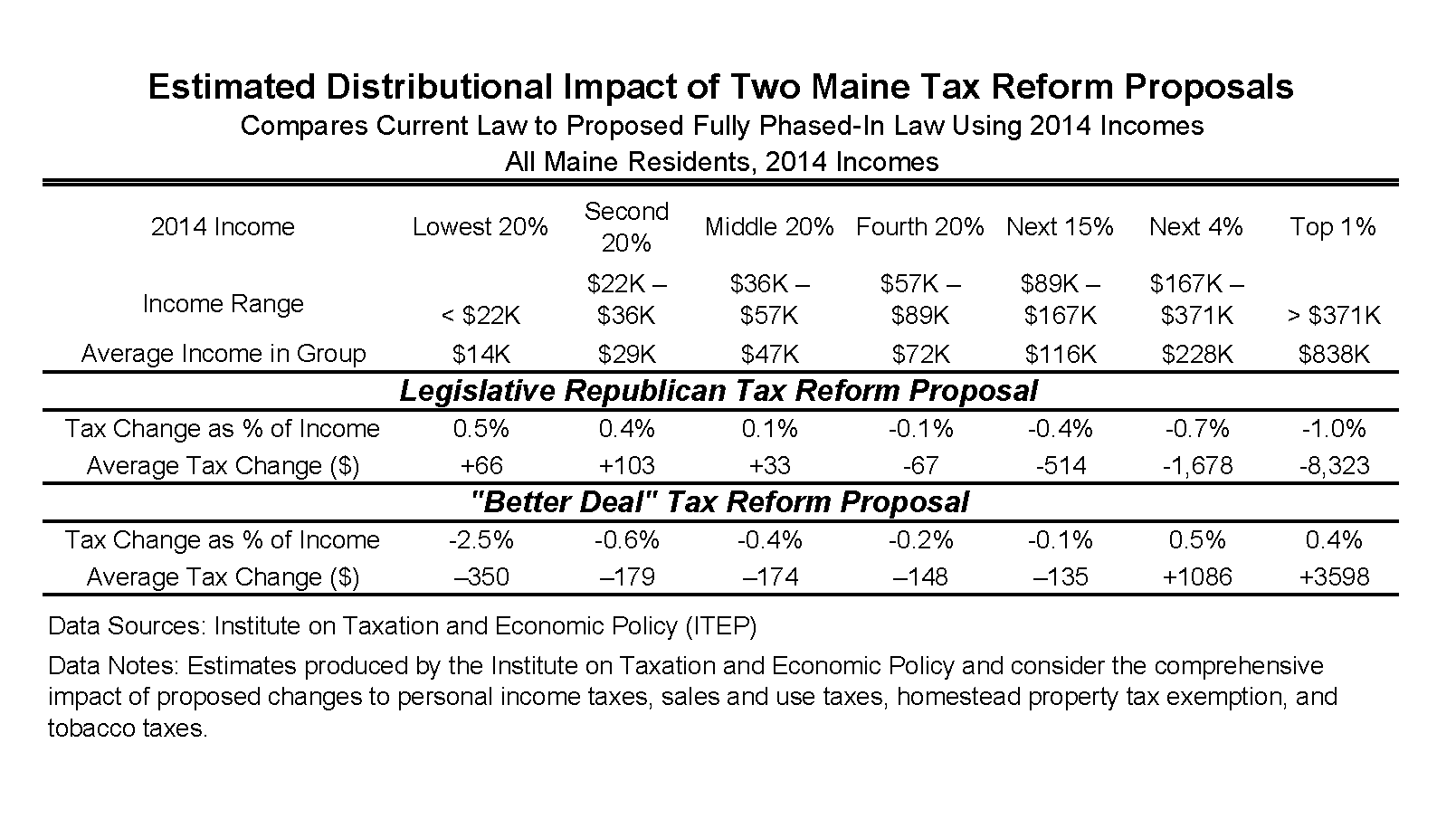

Legislative Republicans have released a tax plan that is a bad deal for working Mainers and seniors living on fixed incomes. Based on preliminary analysis the Maine Center for Economic Policy conducted in conjunction with the Institute on Taxation and Economic Policy, Mainers with income less than $57,000 will, on average, receive a tax increase under the Republican plan. That means approximately 60% of Maine people will get a tax increase on average if the Republican plan passes.

The Republican plan is a bad deal. It prioritizes income tax cuts for the wealthy and corporations at the expense of the rest of us. Future impacts will be even worse as the Republican plan shifts more costs to low- and middle-income property taxpayers and it further compromises the state’s capacity to fund our schools, provide for low-income seniors, children, and people with disabilities, and maintain vital public services.

The Republican plan reflects the discredited theory that income tax cuts will put Maine on the path to prosperity. They won’t. Maintaining public investments in our schools and communities will. And a robust and progressive state income tax is the foundation of such investments. This will not only help secure funding for public investments beneficial to all Maine families and businesses, it will also create a tax system where what the rich and poor pay in state and local taxes as a share of their income is more fair.

Stay tuned as we release more analysis on the Republican plan. In the meantime, MECEP urges lawmakers on both sides of the aisle to work toward crafting a budget that includes both responsible, fair tax reforms that benefit middle- and low-income families and raises the revenue we need to fund education, health care, and other investments that will improve our economy and create opportunity for all Maine people.