There are two fundamental problems with the governor’s tax reform plan. First, it doesn’t adequately target tax cuts to low- and moderate-income Mainers. Second, it would force cuts to education, health care, and other critical services important to Maine people and businesses.

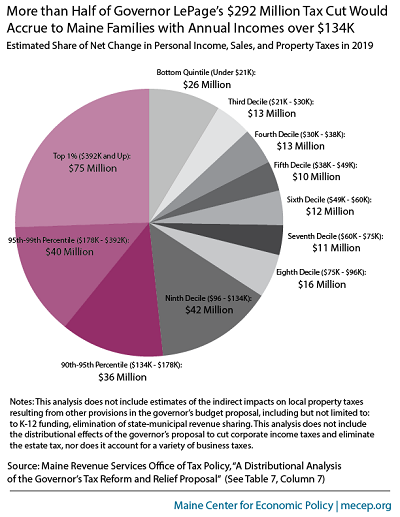

We can see this with a simple pie chart showing information from Maine Revenue Services’ distributional analysis of the governor’s plan. His plan provides $150 million in tax breaks for the top 10% of Maine households. The top 1% of Maine households—Maine’s seven thousand highest-income families—would receive one-quarter of the governor’s overall tax cut.

The “Better Deal for Maine” plan offered by legislative Democrats fixes this problem by targeting all of the tax relief at low- and moderate-income Maine families. On average, Maine families in the bottom 95% of the income distribution would get a tax cut under the “Better Deal” plan, while those in the top 5% of the income distribution would get a modest tax increase. As a result, the “Better Deal” plan would prevent harmful cuts the governor proposes in health care and allow for more investment in education and other foundations of a strong economy. More detailed analysis of the distributional impacts of the governor’s plan and the Better Deal for Maine plan can be found in a brief we released yesterday and covered here by the Portland Press Herald.