For a PDF of this document, click here.

Maine people and businesses count on lawmakers to effectively use taxpayer dollars to help grow Maine’s economy. Continuing ineffective corporate tax breaks when the share of state funding for education is the lowest it’s been in ten years and critical investments in Maine communities are being put on hold makes little sense. Maine lawmakers should reject the LePage administration’s proposal to continue the Maine Capital Investment Credit and redirect any funding identified for this program to more pressing priorities.

Here are six things you should know about the Maine Capital Investment Credit:

- It merely accelerates a benefit that is already available to Maine businesses. The purpose of the Maine Capital Investment Credit was to provide an incentive for businesses to purchase new equipment during the recession. It does this by allowing businesses to depreciate large amounts of their capital expenses in the first year of purchase, for which they receive a windfall tax break. Even without this credit, Maine businesses will still be able to depreciate capital expenses and reduce their taxes, just over a longer time period.

- It doesn’t work. The Maine Capital Investment Credit is based on federal laws that allow businesses to claim bonus depreciation. Nationally, these policies have proven ineffective and rarely factor into business leaders decisionmaking when it comes to purchasing new equipment. Market conditions, customer demand, potential efficiency and productivity gains, and profit expectations are matter much more.

- It primarily benefits large corporations and big businesses. By 2019, large corporations will account for 94% of the costs of continuing the Maine Capital Investment Credit. These companies don’t need windfall tax breaks paid for by hardworking Mainers in order to compete.

- It isn’t paid for and jeopardizes funding for other important priorities. The LePage administration has yet to put forward a plan to fully fund the Maine Capital Investment Credit. Over the next four years, it is projected to cost more than $38 million. Those are funds that could be better spent educating our children, making sure seniors and people with disabilities have access to health care, or ensuring public safety. It makes little sense to prioritize unnecessary and costly corporate tax breaks over prudent public investments that provide long-term benefits for Maine’s people and economy.

- It’s an entitlement that the legislature hasn’t approved. The LePage administration wants to reward businesses for investments that they’ve already made by allowing them to claim the Maine Capital Investment Credit on their 2015 tax returns. That’s not an incentive, that’s an entitlement. In fact, the 2015 tax forms were amended to include the credit before the legislature even began to consider whether or not to continue this program.

- It actually makes Maine’s tax code more complicated. A common misconception among lawmakers is that the Maine Capital Investment Credit simply conforms Maine’s tax code to the federal tax code. In fact, it decouples Maine from the federal code where bonus depreciation is concerned and makes Maine’s tax code even more complicated. That means more tax forms and calculations for businesses and their accountants.

Thirty one states chose not to conform to the federal tax code and give unnecessary tax breaks to corporations for capital expenses in 2015. Maine should follow suit. Lawmakers should strike section 15 from LD 1564, “An Act to Update References to the United States Internal Revenue Code of 1986 Contained in the Maine Revised Statutes” to eliminate the Maine Capital Investment Credit. There are more effective ways to target assistance to Maine businesses and workers and to grow the state’s economy.

Frequently Asked Questions about Business Taxes, Depreciation, and the Maine Capital Investment Credit

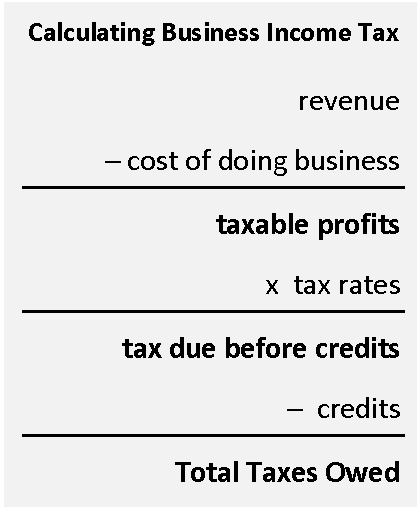

Businesses are only taxed on their profits. To calculate profits for tax purposes, businesses subtract their cost of doing business from their total income or revenue. Deductible costs of doing business include salaries, employee benefits, operating costs, inventory, depreciable capital investments, loan interest, and losses.

What is depreciation?

Capital investments like vehicles, equipment, and software lose value over time as the investments age and become obsolete. Businesses use depreciation to account for the loss of value incurred by capital investments each year. Most businesses depreciate the entire purchase cost of capital investments over 5-7 years and deduct the depreciated amount from their revenue. For example, a business that purchases a vehicle will depreciate 20 percent of the vehicle cost each year over the 5 year expected life of the vehicle.

What is bonus depreciation?

Bonus depreciation allows businesses to depreciate a much greater portion of the cost of qualifying capital investments in the initial year of purchase than a normal depreciation schedule would allow. Recently enacted federal bonus depreciation rules allow businesses to depreciate 50% of the cost of qualifying capital investments that exceed $2.5 million in the first year of service.

What happens to businesses that purchase less than $2.5 million in equipment?

Businesses with purchases less than $2.5 million may depreciate up to $500,000 as part of a separate state and federal program that targets small businesses known as Section 179 depreciation. For amounts between $500,000 and $2 million, businesses claim bonus depreciation at 50% of the remaining balance. For investments over $2 million and less than $2.5 million the Section 179 depreciation limit is reduced dollar for dollar. That means a business with $2,250,000 in capital expenses can depreciate $250,000 through Section 179 and $1,000,000 ($2,000,000 x 50%) as part of federal bonus depreciation.

How does the Maine Capital Investment Credit work?

The Maine Capital Investment Credit is a program that piggybacks federal bonus depreciation rules to reduce state taxes for businesses that purchase equipment in any given year. Unlike federal bonus depreciation which reduces taxes owed by reducing taxable profits, Maine’s program reduces taxes owed by adding back the value of the depreciation amount to taxable profits and then applying a nonrefundable tax credit to taxes owed. This credit is equal to the top income tax rate multiplied by the reported federal bonus depreciation. Any unused portion of the credit may be rolled forward for up to 20 years. For businesses with purchases in excess of $2.5 million, the credit claimed can equal as much as 9% of the value of federal bonus depreciation.

How many businesses claim the Maine Capital Investment Credit?

Because of the different ways in which businesses are incorporated, it is difficult to know exactly how many businesses claim the credit in Maine or where they are headquartered. For example, individuals affiliated with S-Corporations and Partnerships claim the credit on their individual income taxes meaning the same business could be represented by tens or even hundreds of individuals. C–Corporations claim the credit on corporate income taxes. Based on the design of the credit and data from the fiscal note, it is safe to say that few small businesses benefit from this program and that the bulk of the benefits go to corporate filers.