Recently, my colleague Jody Harris posted about how devious payday lenders prey heavily on women. She added that, “Women continue to earn less than their male counterparts, and they also continue to be the ones who assume responsibility for taking care of children and elder parents.” Jody also noted that “Another troubling consequence of all this is that women earn less over their lifetimes so they accrue less in Social Security and retirement savings for later in life when they need it.”

As the Portland Press Herald reported, a recent study sheds more light on the chilling impact the earnings gap has on millions of American women as they approach the time of life when most of us look forward to a secure retirement. The authors of Shortchanged in Retirement: Continuing Challenges to Women’s Financial Future, from the non-profit, non-partisan National Institute on Retirement Security, analyzed data from the US Census 2012 Survey of Income and Program Participation (SIPP). The researchers found that:

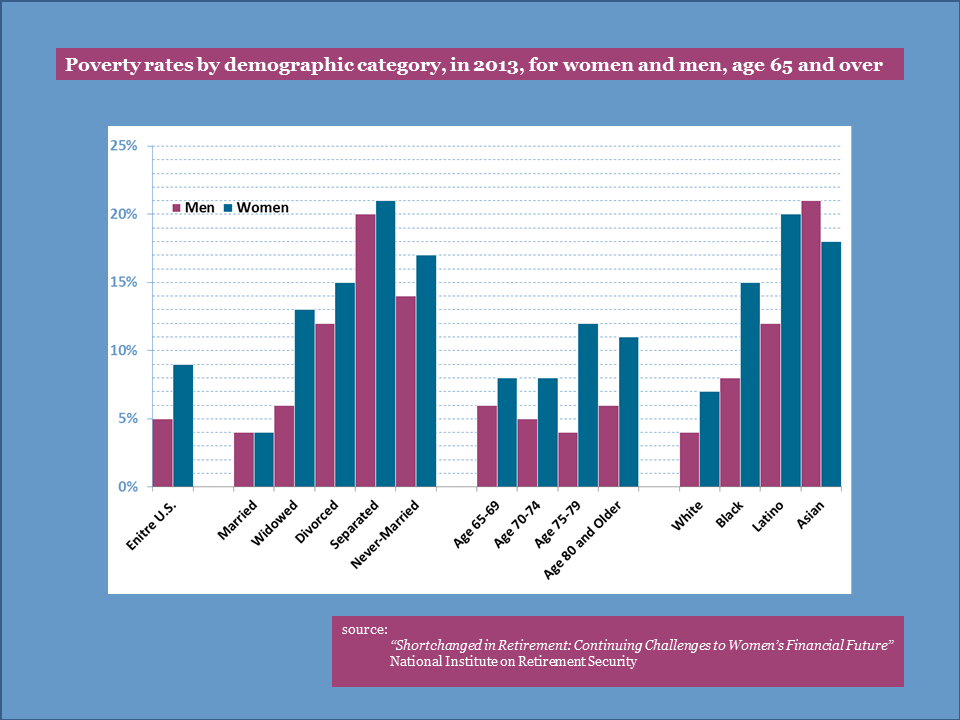

Women are 80 percent more likely than men to be impoverished at age 65 and older, while women between the ages of 75 to 79 are three times more likely than men to be living in poverty. Widowed women are twice as likely to be living in poverty than their male counterparts. White and black women are almost twice as likely to be living in poverty than their male counterparts during retirement.

The study’s authors recommend a number of possible ways to address this disparity and keep more women out of poverty in retirement. These include strengthening Social Security by making the spousal benefit equal to 75 percent of the sum of the spouses’ combined worker benefits, adopting the Consumer Price Index for the Elderly (CPI-E) cost of living adjustment, lowering the number of years of marriage required to receive Social Security spousal benefits to seven years to protect divorced women, and creating caregiver credits for women who leave the workforce temporarily to care for children or elderly relatives.

Another vehicle for providing retirement security for all Americans including millions of women is encouraging and providing easier access to individual retirement accounts (IRAs). One such proposal is the Auto IRA, automatic enrollment in payroll deduction IRAs .This is a bipartisan concept from the Brookings Institute and the Heritage Foundation and supported by the Obama administration. About half of American workers, and 75 percent of part-time workers, including more than 254,000 Maine workers, currently lack access to employer-sponsored retirement plans like 401(k)s.

Auto IRA automatically enrolls employees in workplace pension plans but allows them to opt out if they choose. Auto IRA requires most employers with 10 or more employees who do not currently offer a retirement plan to enroll their employees automatically in a direct-deposit IRA account that is compatible with existing direct-deposit payroll systems. AARP has found that “[b]y removing administrative barriers to saving, automatic enrollment can increase the likelihood that workers will contribute to retirement.”[i]

In 2014, President Obama directed the Department of the Treasury to create a voluntary form of Auto IRA called myRA, which allows employees who sign up to have a portion of their paycheck (as low as $5) directly deposited automatically every payday. While myRA provides employees an option, President Obama, retirement security advocates, and many in Congress continue to press for adoption of Auto IRAs, nationally or at the state level. In 2015, Representative Henry Beck of Waterville introduced LD 1318, “An Act To Promote Individual Private Savings Accounts through a Public-private Partnership,” a bill to encourage Auto IRAs in Maine, which died in the State Senate.

Our retirement policies should no longer penalize women because of continued pay inequity and their contributions to our nation’s economy and society as caregivers. We have the facts; now we need the political will to resolve these discrepancies and ensure our mothers, sisters, and someday our daughters will be assured of retirement in dignity and economic security.

[i] B.H. Harris and R.M. Johnson, 2012 (Feb.), “Economic Effects of Automatic Enrollment in Individual Retirement Accounts,” AARP Public Policy Institute, 2012-04, p.3.