In a new report, the Institute on Taxation and Economic Policy reveals that tax cuts since the George W. Bush administration have disproportionately benefited the wealthiest American households, contributing to income inequality and undermining the country’s ability to expand opportunity.

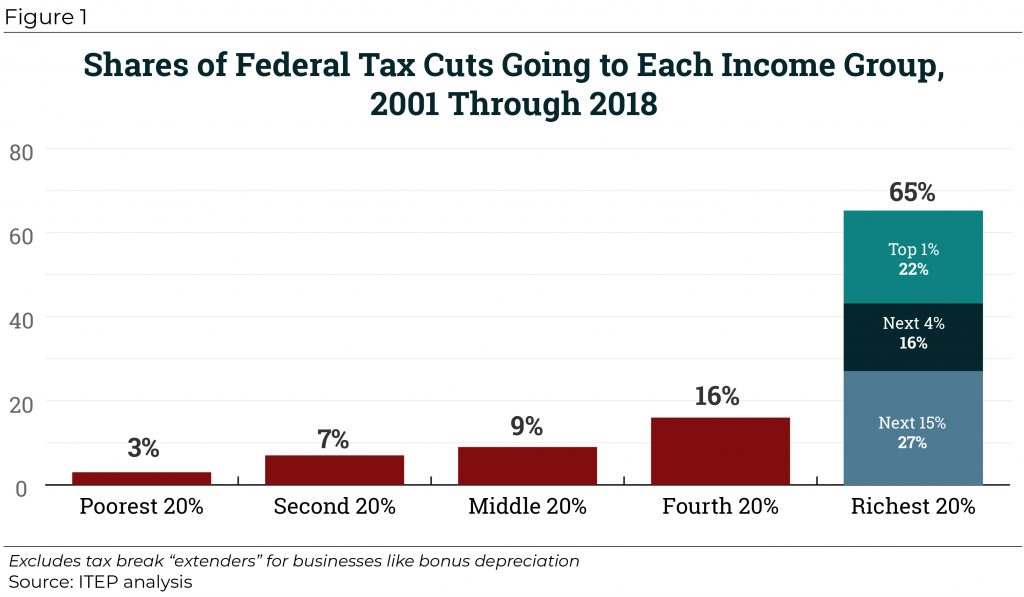

According to ITEP’s analysis, the richest one-fifth of Americans received 65 percent of the tax cuts, with 38 percent of tax cuts’ benefit accruing to the top 5 percent. At the other end of the distribution, the bottom one-fifth of households only received 3 percent of the tax cuts during the same period.

While some tax policy changes enacted during the Barack Obama took small steps to reverse course, they did not alter the core trajectory of tax policy over the past two decades. In sum, federal tax cuts have cost $5.1 trillion and are responsible for $5.9 trillion of our national debt. By 2025, the impact on the national deficit will be $13.6 trillion.

These federal tax policy changes have contributed to widening income inequality. Since 1999, the bottom 40 percent of households have been losing ground on income, while the top 40 percent have seen their income rise. While not the sole contributor to income inequality, the tax choices made at the federal level have worked to exacerbate existing trends by boosting the income of those households already seeing income gains, and largely leaving unchanged the after-tax income of the poorest Americans.

These tax choices also come at a cost to other priorities that help to expand opportunities to low and moderate-income Americans. For example, in the six months since the most recent tax law passed, cuts to federal food assistance, Medicaid, Medicare, Social Security, education and more have all been floated to pay for the tax breaks.

For more information, read ITEP’s full report here.