Last week Republican legislators released their proposal for overhauling Maine’s tax system. The plan includes income and corporate tax cuts, and eliminates the estate tax, all disproportionately benefiting Maine’s wealthiest earners. It also continues the current 5.5% sales tax rate slated to expire later this year, and increases the meals and lodging tax rate to 9%. The Republican plan offers no new property tax relief or credits to improve the fairness of Maine’s tax system, especially for low- and moderate-income earners.

Democratic legislators proposed their own “A Better Deal for Maine” plan in April that targets income tax cuts to middle-income Mainers. Democrats also expanded the homestead exemption and increased the property tax fairness credit to reduce the impact of property taxes for Maine homeowners and renters. Another key feature of the Democratic plan is that it is paid for in future years and won’t trigger cuts in state spending on education and other vital services in the years ahead like the Republican plan will.

Budgets are about choices and priorities. The Republican and Democratic tax plans present very different choices and reflect fundamentally different priorities for overhauling Maine’s tax system. Nowhere is this more apparent than in the distributional impacts of their respective plans.

With their plan Republicans set tax cuts for the rich as their highest priority, and will ultimately saddle working Maine families with higher property and sales taxes. Democrats make tax fairness their top priority, targeting tax cuts to low- and middle-income families while asking the wealthy and corporations to pay their fair share.

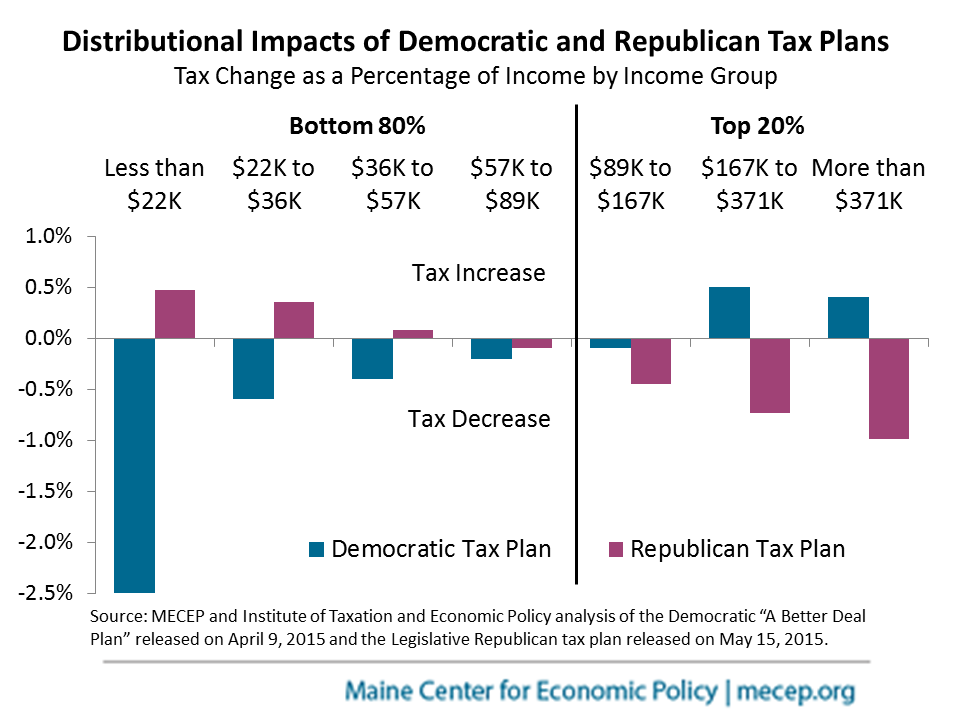

MECEP worked with the Institute of Taxation and Economic Policy to model the impacts of the Republican and Democratic plans for different income groups. This is summarized in the bar chart below. Simply put, the Democratic plan is a better deal on average for Mainers with incomes below $89,000. The Republican plan increases taxes on average for Mainers with incomes below $57,0000 and targets tax cuts to the top 20% of Mainers whose income is above $89,000. Stated differently, on average the bottom 80% of Mainers fare better under the Democratic plan while the top 20% benefit more from the Republican plan.

The fact that the Democratic and Republican plans diverge so greatly in their impacts reflects the different choices each made in crafting their respective plans. The Republican approach to reducing income taxes, especially lowering the top income tax rate, skews the benefits toward wealthier Mainers. That’s because income taxes account for the largest share of state and local taxes the wealthy pay. For middle-income Mainers, income taxes account for the smallest share of state and local taxes when compared to property and sales taxes. If middle class tax relief is the goal, across the board reductions in property taxes would be more beneficial than an across the board income tax cut all else being equal. The same is true for the bottom 20% of Mainers who have no income tax liability on average and are hit hardest by sales taxes followed by property taxes.

The Republicans could change their mix of winners and losers in several ways. They could restructure their income tax cut to deliver more targeted benefits to low- and middle-income taxpayers, not just the wealthy. They could pair income tax cuts with property tax cuts which will deliver greater benefits to low- and middle-income taxpayers. Or, they could expand tax credits like the property tax fairness credit or the earned income tax credit to deliver more tax relief to low- and middle-income Mainers. Of course, none of these options are viable if there is not enough revenue to address shared spending priorities in the first place.

The Democratic plan effectively integrates all three of the strategies outlined above to deliver the most positive results overall for low- and middle-income taxpayers. They intentionally structured their income tax cut so that it is not just a giveaway to the wealthy. The plan significantly increases property tax relief and it retains the tax credits offered by the governor in his plan. Finally, Democrats provide the revenue now and in the future to fully fund their tax cuts without jeopardizing state and local services on which Maine people rely. Ultimately that is why it is not just a better deal for the bottom 80% of Mainers, but a better deal for all Mainers.