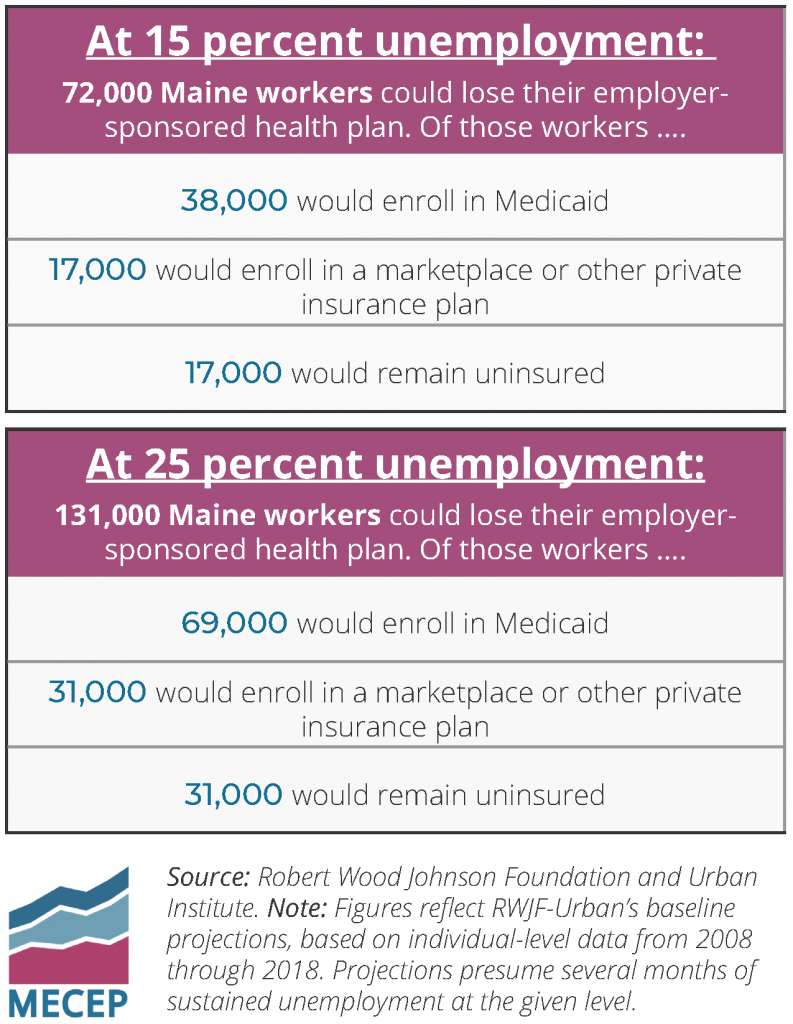

Between 72,000 and 131,000 Mainers could lose their employer-sponsored health insurance as a result of widespread layoffs spurred by the coronavirus pandemic, with as many as 31,000 unable to obtain any other form of insurance after their layoff.

That’s according to new analysis by the Robert Wood Johnson Foundation and the Urban Institute, with the range of outcomes dependent on the severity of the unemployment crisis.

Because the American health care system ties coverage to employment, loss of insurance coverage compounds the crisis for Mainers facing a loss of income because of a temporary or permanent layoff. Even those employers that are continuing to provide insurance coverage during temporary layoffs may find themselves unable to continue if the economy remains constrained by the pandemic.

Data so far suggests that 40 million Americans have lost their jobs since the pandemic reached the United States. The Maine Department of Labor estimates that around 163,000 individuals have filed claims for unemployment benefits since March 15. However, given the unprecedented nature of this public health and economic crisis, it is unclear what share of the layoffs will be temporary or permanent. Some laid-off workers may be able to return to work once there is a plan to safely resume economic activity, while others will have lost their jobs permanently if their employers close for good.

The RWJF-Urban analysis accounts for this uncertainty, by providing estimates of health insurance losses at different levels of unemployment (15 percent, 20 percent, and 25 percent), and by using two different models.

The first model lays out a base scenario, projections from which are cited above and in the tables below, incorporates individual-level data from a 10-year period between 2008 and 2018. This model incorporates the timeliest understanding of today’s health insurance system, but includes data from only one recession.

An alternate “high” scenario is derived from a model utilizing a larger set of data over a 20-year period from 1998 to 2008. It has the advantage of covering multiple economic downturns, but reflects a period of time before implementation of the Affordable Care Act, and other policy changes that affect insurance status in periods of high unemployment.

That scenario is far more dire, projecting that between 122,000 and 221,000 Mainers could lose their employer-sponsored health insurance plans, depending on the peak unemployment rate.

In each of the scenarios, a little more than half of the population losing their employer-sponsored insurance is expected to enroll in the state’s Medicaid program, MaineCare. In this regard, Maine will benefit from the 2017 referendum to expand Medicaid eligibility to more low-income Mainers through the Affordable Care Act. The RWJF-Urban report estimates that the number of people without any insurance at all will be much larger in states that have not expanded Medicaid. Maine must continue to protect and fund MaineCare to preserve this crucial support.

Without health insurance, laid-off Mainers could face ruinous medical bills and have reduced access to health care during an ongoing public health crisis. The new report reminds us that an economic downturn can create additional hardships beyond a loss of wage income.

Loss of health insurance will increase the suffering caused by COVID-19. Policymakers can mitigate the harm by protecting and strengthening public health programs such as Medicaid. For example, Congress should increase federal matching funds for Medicaid coverage — an especially urgent policy given the increased demand the pandemic will put on the program and the plummeting revenues at the state level.