Building an inclusive economy requires tax policy that meets two conditions. The first is that those with the most are asked to pay more, or at the very least pay as great a share of their income in taxes as everyone else. The second is that enough shared resources are raised through the tax code to invest adequately in foundations of a strong economy including good schools, access to health care, and safe and modern infrastructure.

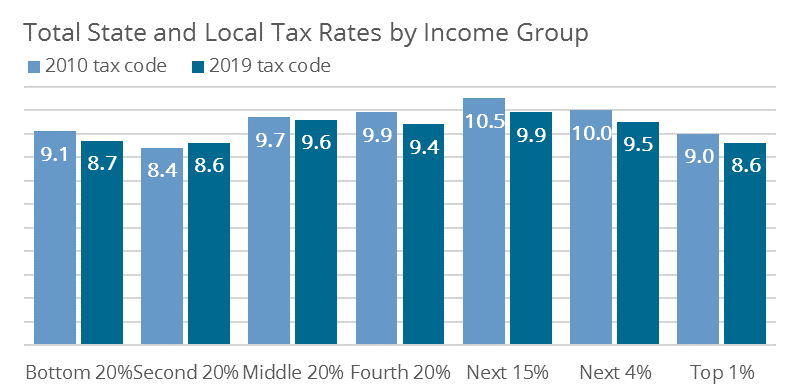

Forty-five states, including Maine, still require the lowest income residents to pay a higher percentage of their incomes in state and local tax codes than the richest. While new analysis from the Institute on Taxation and Economic Policy shows that state and local taxes paid by the bottom 20 percent of households as a share of income has gone down since 2010, it has also gone down for wealthy Mainers. These changes, while doing little to improve the overall distribution of who pays for these groups, come at a cost.

Source: ITEP Who Pays? 6th edition and additional data provided by ITEP of total state and local tax data without the federal tax offset

Maine is one of more than a dozen states that pursued drastic income tax cuts since the Great Recession. In Maine, these cuts mean that we are raising $430 million less per year in income taxes compared to the 2010 income tax code. About half of these income tax breaks went to the top 20 percent of Maine families. By contrast, the bottom 20 percent of households account for less than 5 percent of the income tax cut.

Tax cuts for wealthy families show little to no impact on improving economic outcomes. Instead these tax cuts cost hundreds of millions in public resources. Since the recession began, state’s around the country have fallen down on their investments in the foundations of their economy such as higher education, k-12 education, and infrastructure. For each of these categories, Maine is still spending below pre-recession levels.

In addition to a significant loss of revenue, ITEP’s 6th edition of their cross-state Who Pays? analysis reveals another troubling trend of the LePage-era tax policies. While upper-income households saw clear reductions in the share of income they now pay in state and local taxes, lower- and middle-income households haven’t fared as well. That’s because the loss of income tax revenue was partially offset by increased sales and property taxes which tend to have a greater impact on low- and middle-income households.

As a result, the 20 percent of households with income between $23,000 and $41,000 actually saw their taxes go up as a share of income compared to the 2010 tax code and households with income between $41,000 and $63,000 saw almost no improvement. The only reason the bottom 20 percent of households didn’t get hit harder by these changes was largely due to improvements to several tax credits proven to reduce poverty and improve economic security for low income families.

While Maine admittedly fares better than most states in the distribution of who pays taxes in the state, the reality is that all states – including Maine – still have work to do to build a tax code that asks more of those with the greatest ability to pay and that secures the necessary resources to maintain investments in the foundations of a strong economy.