At a glance:

- The Tax Cuts and Jobs Act (TCJA) of 2017 expires in 2025, offering Congress a chance to reshape tax policy and reverse regressive measures that weakened the US tax base.

- The TCJA primarily benefited corporations and wealthy individuals, while delivering little to no economic benefits for average Americans or workers.

- Extending the TCJA would cost an estimated $400 billion annually, diverting funds from essential services like health care, education, and infrastructure.

- Maine policymakers have already started to distance the state from harmful federal tax policies, showing a commitment to a fairer, more progressive tax code.

- The upcoming decisions in Congress and Maine offer a chance to promote tax fairness and ensure the wealthy and corporations contribute their fair share.

The Tax Cuts and Jobs Act (TCJA) of 2017 expires at the end of 2025, giving the next Congress a chance to rethink tax policy and undo the regressive measures that have weakened the US tax system. Maine’s tax laws may also be affected, depending on how closely the state aligns with federal changes.

The TCJA disproportionately benefits corporations and people with wealth

The TCJA primarily benefited wealthy individuals and corporations, offering huge tax breaks to big businesses while delivering little to no benefit for everyday Americans.1 The corporate tax rate was slashed from 35% to 21%, but after loopholes, exemptions, and deductions, large profitable corporations saw their effective tax rate drop below 13%. In four years, the top 296 corporations paid $240 billion less in taxes.2 In short, the TCJA largely benefitted executives and top earners, with no evidence of significant benefits to workers.

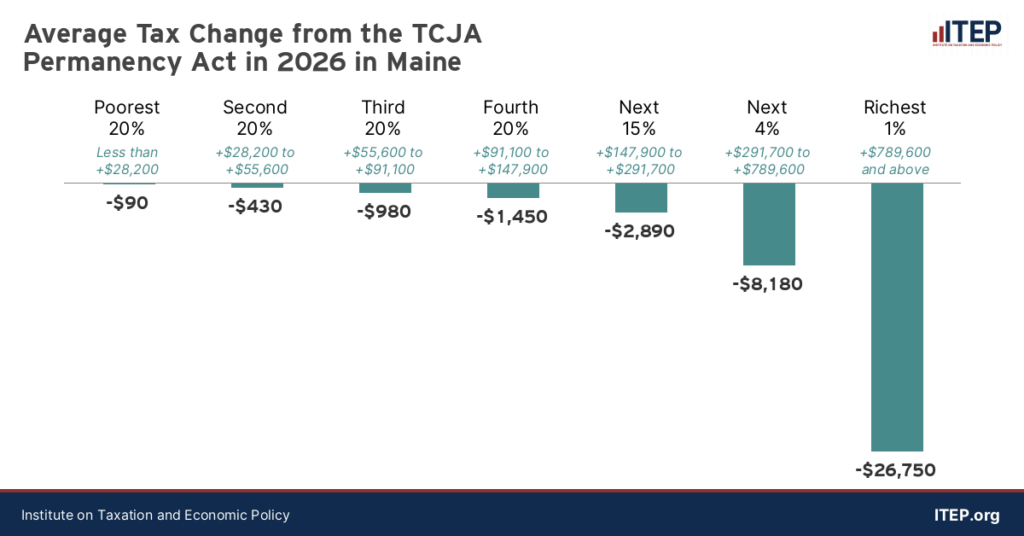

According to the Institute on Taxation and Economic Policy (ITEP), making the TCJA tax cuts permanent would give the top 1% in Maine an average tax cut of $27,000 while middle-income earners would receive modest cuts between $430 and $1,450. Meanwhile, Mainers in the bottom 20% would see an average tax cut of just $90. Wealthy households also gained the most from corporate tax breaks, as they own the majority of shares in large companies.

The TJCA comes with great costs

The Congressional Budget Office found extending the TCJA cuts would be even more costly than originally anticipated, with estimates ballooning each year over prior expected numbers. Extending the TCJA will have an estimated cost of over $400 billion per year,3 siphoning money away from important priorities, like housing, education, health care, and other investments in our communities that would help our economy thrive.

A chance is coming to restore tax fairness

Congress and the next president can reverse TCJA’s damage on tax fairness and federal revenues. Regardless of what happens in Washington, policymakers in Augusta can choose not to repeat the mistakes of the TCJA at the state level. Last year, legislators voted to decouple certain state income tax provisions from federal law, preserving the higher standard deduction regardless of what happens at the federal level,4 showing a willingness in Maine to depart from decisions made at the federal level.

The fight for the future of our tax code and tax fairness matters. Taxes are how we raise funds for important priorities, like our roads, bridges, schools, and social services. Instead of doubling down on tax policies that further inequality, we should ask more of those who benefit the most from our economy by enacting a more fair and progressive tax code. It’s time for the rich and corporations to pay their fair share.

Notes:

- Center on Budget and Policy Priorities, “Congress Should Revisit 2017 Tax Law’s Trillion Dollar Rate cut in 2025.” 21 March 2024.

- Institute on Taxation and Economic Policy, “Corporate Taxes Before and After the Trump Tax Law,” 2 May 2024.

- US Senate Committee on Budget, “Extending Trump Tax Cuts Would Add $4.6 Trillion to the Deficit, CBO Finds.” 24 May 2024.

- LD7, ultimately enacted as part of the FY24-25 state budget, LD 258.