What is tax fairness?

Taxes help pay for things that benefit everyone, like good schools, clean air and water, and safe roads. Businesses also need these things to succeed, along with a healthy, housed, and educated workforce, modern infrastructure, and affordable energy. Fair taxes mean everyone pitches in according to their means, so those who have less pay less, and those who have more pay more. Unfortunately, the vast majority of states still have upside-down tax structures, meaning that families with wealth pay a smaller portion of their income in taxes than families with low income. That’s not fair.

Most public services are funded by a mix of income, property, and consumption taxes. Some states decide to get rid of income taxes altogether. But when they do, they often raise other taxes and reduce support for essential services and infrastructure. This hurts people with low income the most and worsens economic and racial inequality. Ultimately, the “no income tax” approach to taxation means people with low and middle income end up contributing a greater share of their income towards shared services and infrastructure than people with wealth but get less of the benefit. That’s not fair either.

Why is tax fairness important?

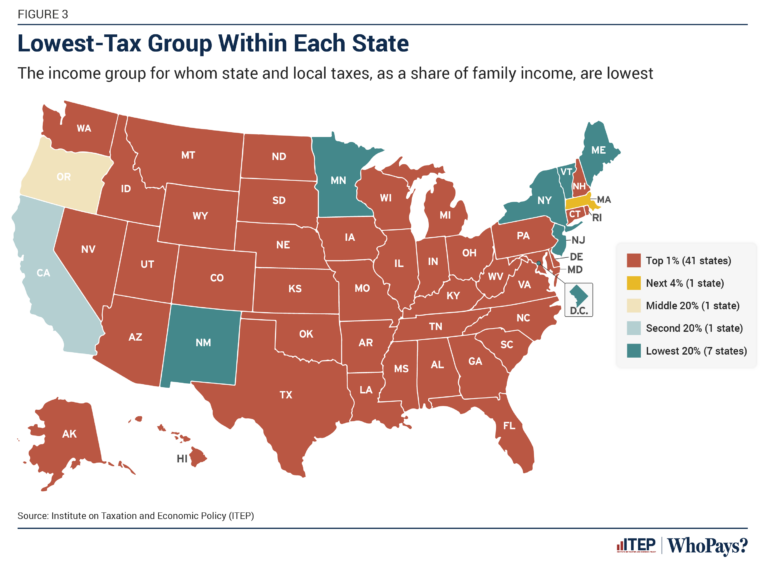

- Unfair tax structures worsen income inequality. New state-by-state analysis from the Institute on Taxation and Economic Policy (ITEP) shows that on average, the least wealthy 20% of taxpayers pay state and local tax rates that are nearly 60% higher than the wealthiest 1%. In 41 states, the wealthiest 1% are taxed at a lower rate than everyone else. In the most unfair states, families with low income pay three to five times as much of their income as those with wealth.

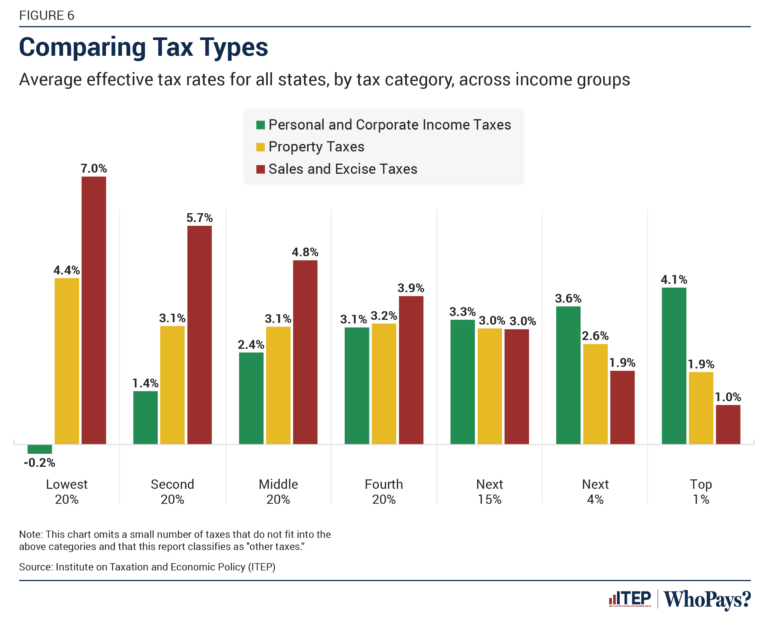

- States described as “low tax” are often high tax for families with low income. When states move to eliminate or flatten personal income taxes, they often make up for the lost revenue by raising other taxes, like property and consumption taxes. These taxes hit people with low income hardest, as they typically spend about three-quarters of their earnings on items subject to sales tax, while top earners only spend about one-sixth of earnings on these items.

- Unfair tax structures and enforcement worsen racial inequality. Taxing people with lower income and their work-based income at higher rates than wealthy people and their unearned income negatively and disproportionately impacts people of color. In the US, the typical white family has eight times the wealth of the typical Black family, and yet Black Americans have been found to be three to five times more likely to be audited than taxpayers of other races. Wealthy white people are also significantly more likely to have sources of unearned income, including stock.

- Unfair tax systems shift costs to workers and small businesses. Taxpayers with higher incomes can exert political influence and employ advisors to exploit complicated loopholes and accounting schemes to avoid paying what they owe. Following the Trump tax cuts of 2017, corporations spent $1 trillion on stock buybacks, further enriching shareholders while workers’ wages barely kept pace with inflation.

- Unfair tax structures cost the US billions every year. New estimates show that extending the Trump tax cuts of 2017 will cost $4.6 trillion over the next decade. In addition, the US Treasury estimates the wealthiest 1% use loopholes and other strategies to hide their wealth and underpay their taxes by $163 billion each year. Tax avoidance by the wealthiest 1% accounts for nearly 30% of what the government is shortchanged annually.

How do Maine’s tax structures compare?

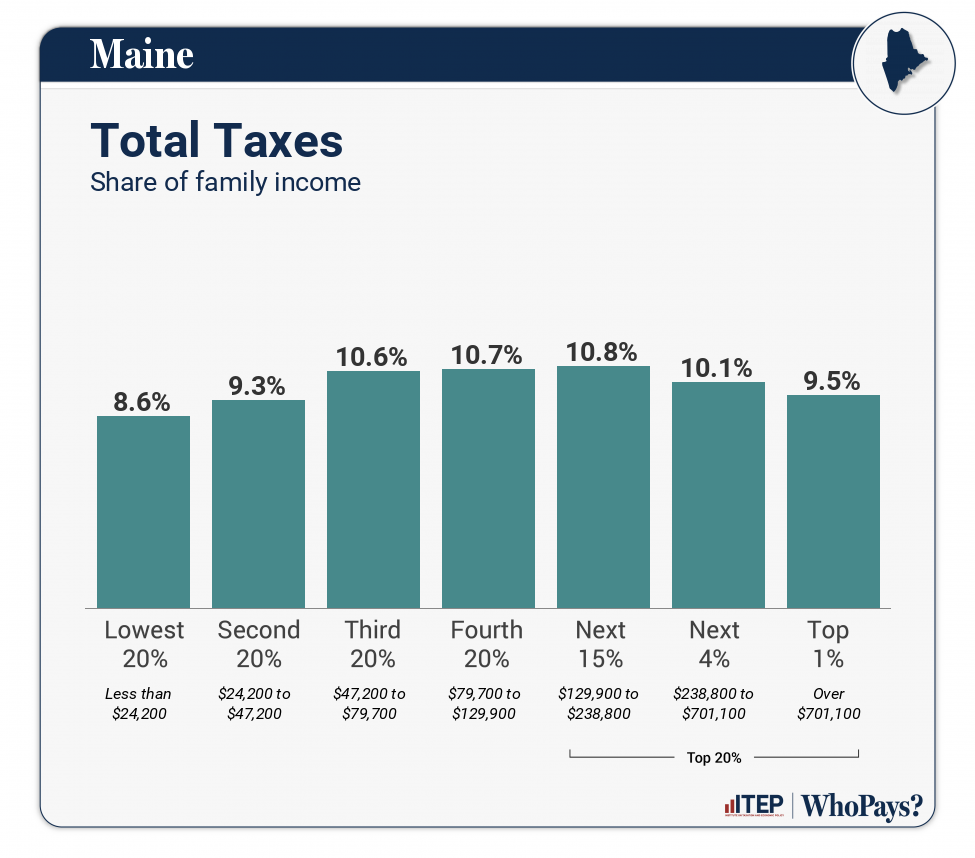

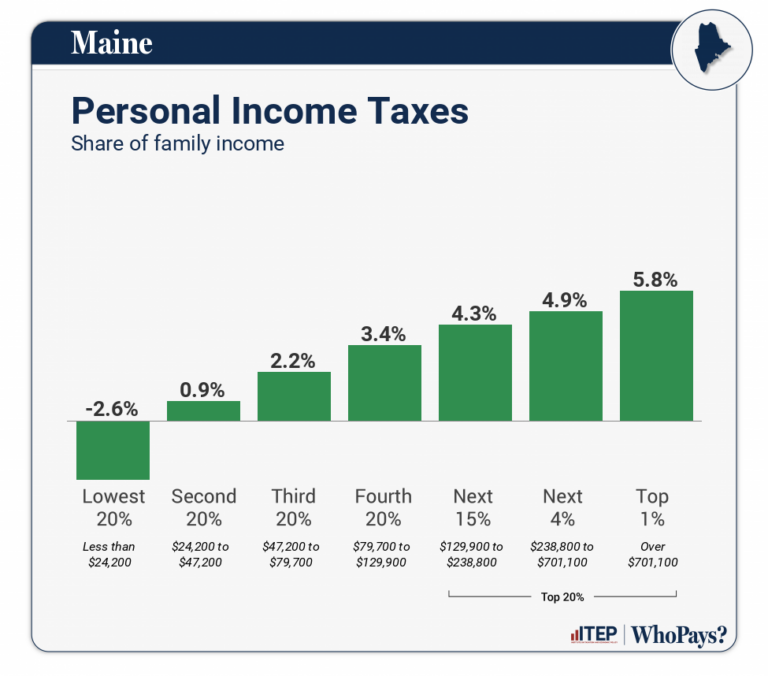

According to ITEP’s analysis, Maine is one of only seven states with tax structures that reduce rather than increase inequality. In New England, only Vermont has fairer tax structures.

In recent years, Maine has made strides to increase fairness by targeting tax credits to people with low income. For example, Maine has increased its Earned Income Tax Credit fivefold since 2019, removed minimum income qualifications for its child tax credit and sales tax credit and introduced a dependent care tax credit and a property tax fairness credit.

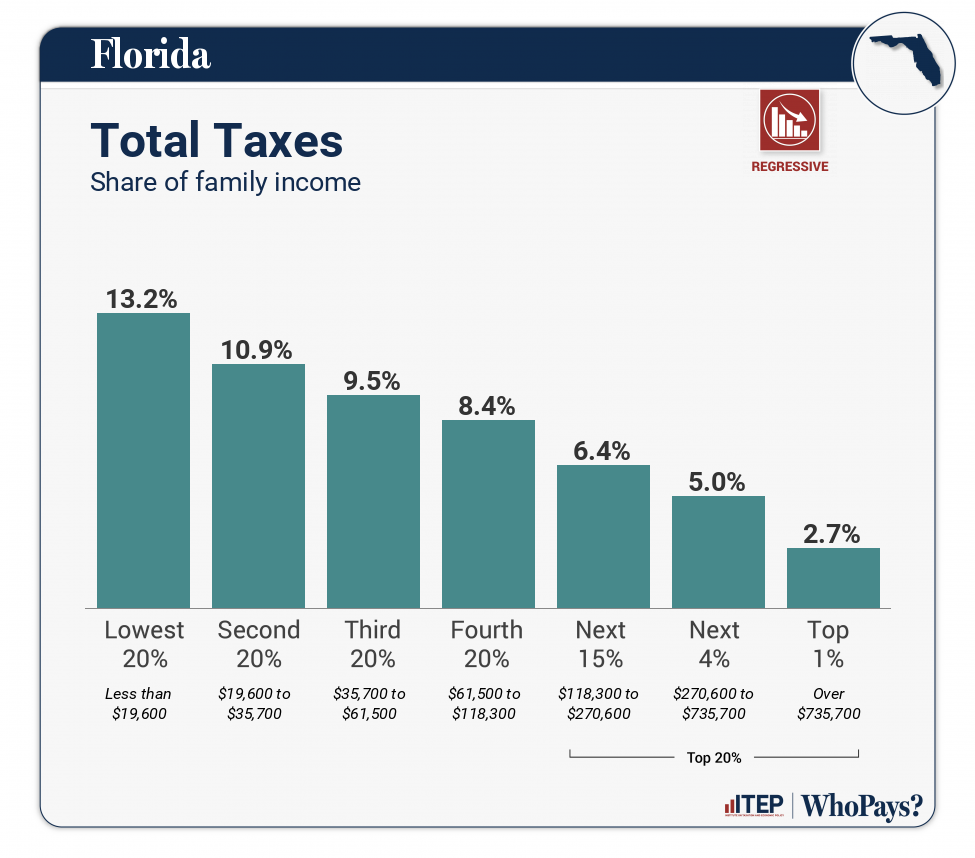

In contrast, Florida, which has the least fair tax system in the US, relies heavily on sales taxes because it doesn’t have an income tax, and it lacks targeted tax credits that create balance for families with low income. As a result, families with low income in Florida pay almost five times more of their income in taxes than the wealthiest families do, and 35% more than their counterparts in Maine.

By maintaining a fairer tax system, Maine has also been able to sustain the funding to enact bold policies that build economic opportunity and further reduce costs for working families, including free school meals, free community college, child care and energy subsidies, paid family and medical leave, expanded access to Medicaid, and new affordable housing construction.

Income taxes

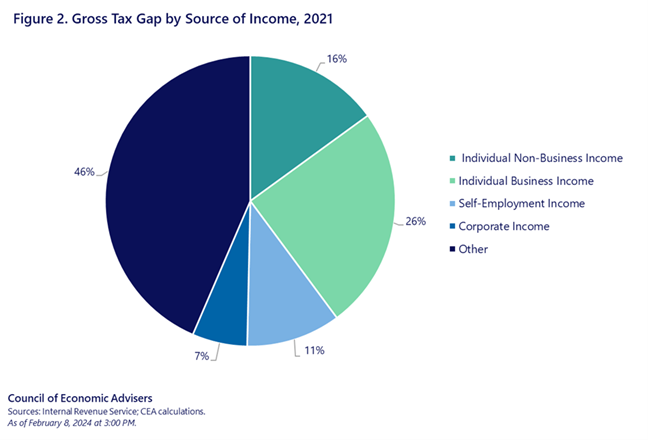

Income taxes play a significant role in our economy, but just as important are the taxes that go unpaid. The “tax gap” — the difference between what taxpayers owe and what they pay — was $688 billion in 2021. That represents a quarter of the federal tax receipts and about 3% of the nation’s total economic output. This gap comes from people with wealth and corporations exploiting loopholes, complex schemes, lax reporting laws, and gutted enforcement capacity to hide their income, along with other nonfiling, underreporting, and underpayment.

Personal income taxes

On average in the US, income tax rates go up as income goes up. Additional tax credits targeted to working families with low-income help offset other forms of taxes that are less fair. However, there’s a hidden issue with income taxes: money earned from investments, like stocks and bonds, isn’t taxed as it grows, unlike income from working. This makes it even tougher for working class families to get ahead.

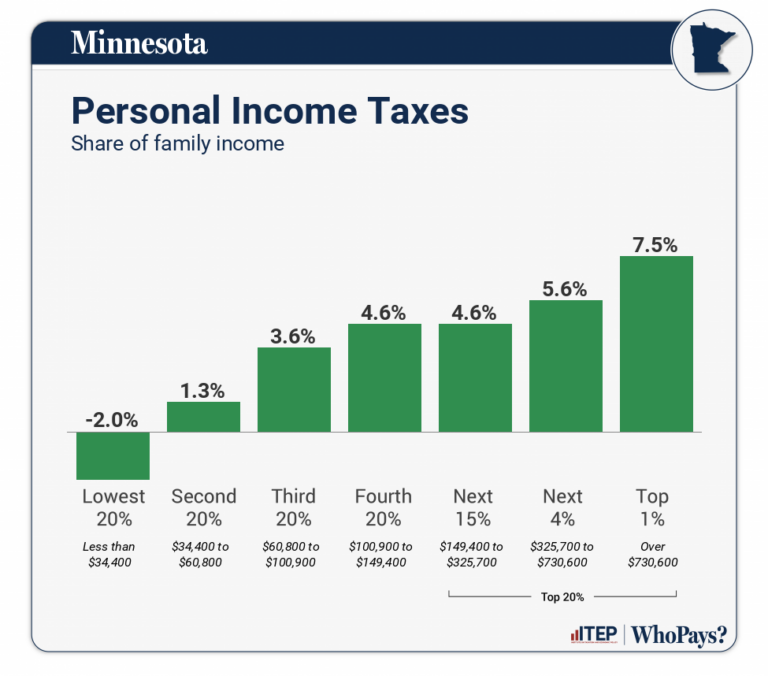

Minnesota has the second fairest tax structure in the nation after Washington, DC. Like Maine, it has robust tax credits for working families, a state-level estate tax, and limits itemized deductions for the wealthy. But what sets Minnesota apart is its approach to taxing high investment incomes and its graduated income tax brackets that apply higher rates to higher earnings. While Maine’s income tax bracket also increases with the amount of income earned, it only has three brackets. The top tax rate starts at just $61,600 for single filers and $123,250 for those married filing jointly, resulting in a large share of middle-income families paying the same rate as millionaires in Maine.

ITEP’s charts show the share of family income spent on income taxes after tax credits and exemptions are factored in.

Why aren’t flat income taxes fair?

Flat income tax taxes apply the same percentage of tax to everyone’s income, no matter how much they earn. At first glance, this might seem fair, but it overlooks the impact of other taxes, like sales and property taxes, which hit people with lower incomes harder. As a result, people with low and middle incomes still end up paying a larger portion of what they earn in taxes, leaving them with less money for essentials like housing, food, and health care. Meanwhile, wealthier people, who can afford to pay more, end up contributing a smaller percentage of their income in taxes. This not only undermines funding for public services and infrastructure but also perpetuates greater inequality in society.

Corporate income taxes

Business income reported on individual and corporate tax returns accounts for 44% of the tax gap. While the federal government has started taking steps to tackle this issue by improving IRS capabilities to target high-income and large corporate tax evaders, as well as implementing an alternative minimum corporate tax, many states, including Maine, lag behind. In Maine, there’s very little information available about whether corporations operating here are paying their share of state taxes because reporting requirements are minimal.

Much of Maine’s corporate tax base is comprised of multinational corporations like Amazon, Walmart, Apple, Microsoft, and pharmaceutical companies. These corporations sell their products in Maine but are based elsewhere. They pay taxes based on a percentage of their income from sales here. But when these corporations hide their profits in offshore tax havens, those profits aren’t included in the federal or state tax calculations. Each year, tax haven abuse costs the US $60 billion and Maine an estimated $52 million. Many of the big corporations dodging taxes are the same ones getting special tax breaks from both federal and state governments.

“Pass-through” entity income taxes

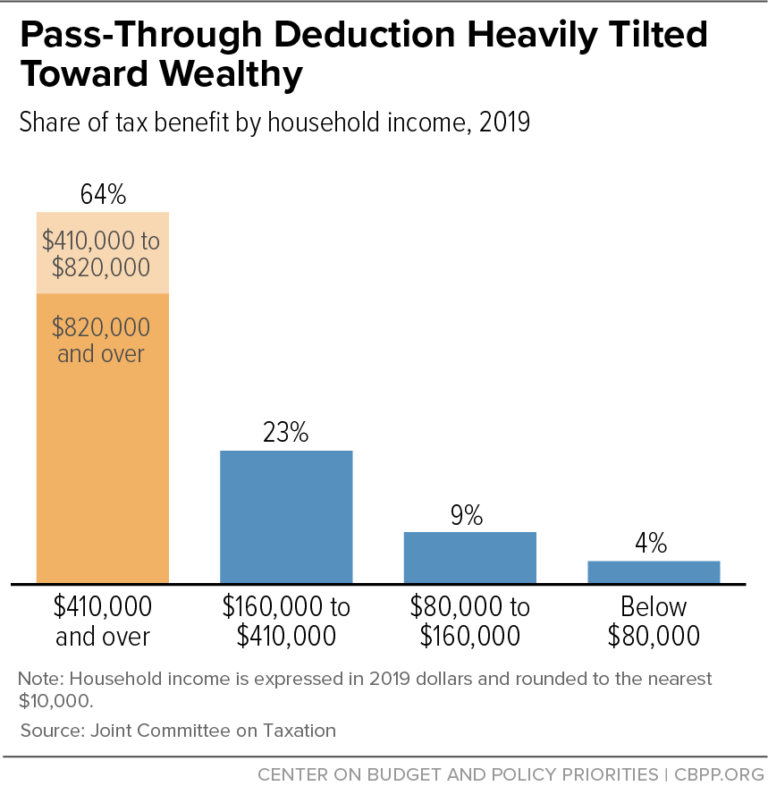

95% of businesses in the US today are “pass-through” entities not subject to the corporate tax paid by C-corporations. Pass-through entities, such as partnerships, S corporations, and sole proprietorships, allow income to “pass through” to their owners, who then report it on their individual income tax returns. Because these entities underreport at a high rate, they represent the single largest source of the tax gap.

Pass-through entities have minimal reporting requirements and are rarely audited, creating a fertile environment for underreporting, evasion, and tax haven abuse by the wealthy. While sold as a small business benefit, more than 60% of the 2017 tax cut directed at pass-through entities ultimately benefitted the wealthiest 1%, at a cost of roughly $50 billion in revenue each year. Many of these tax benefits are set to expire in 2025, presenting Congress with an opportunity to reshape the tax code in a fairer way.

Property taxes

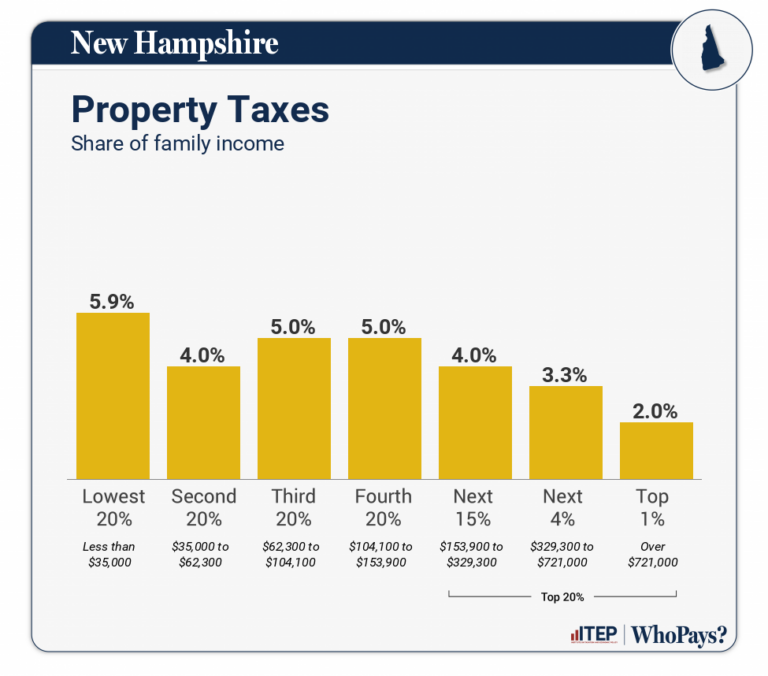

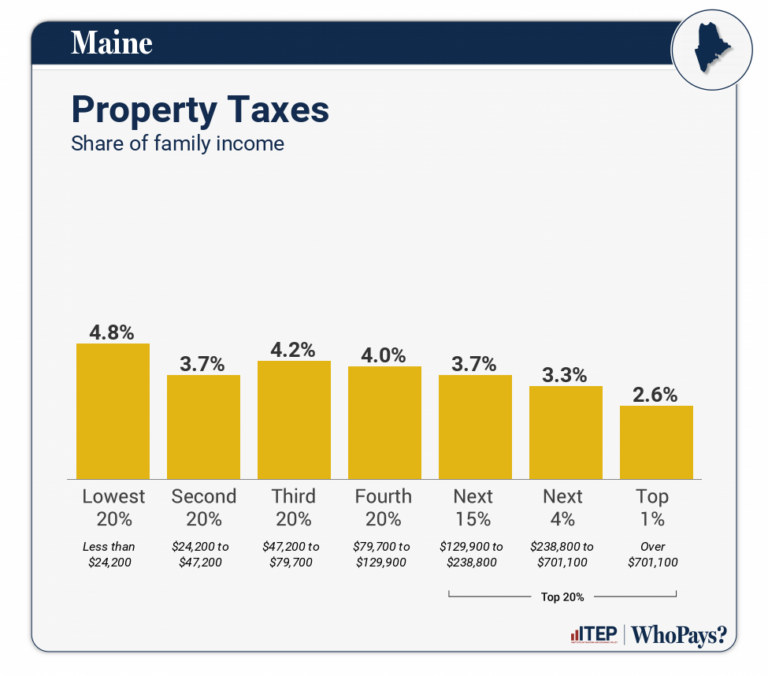

On average, property taxes can hit families with low income the hardest because those families typically spend a greater share of their income on property taxes than everyone else. This includes both renters and homeowners with low income. Many states with flat or no income taxes look to property taxes to raise revenue. New Hampshire, which has no personal income tax, relies heavily on property taxes to make up revenue, resulting in the third highest property tax rate in the nation. All but the wealthiest 5% in New Hampshire pay a greater percentage of their income in property taxes than families in Maine.

Communities with big box stores can lose out on millions in local tax revenues when those wealthy corporations employ shady practices to reduce their property taxes. Maine recently enacted a policy to prohibit “dark store” tax evasion.

Sales and excise taxes

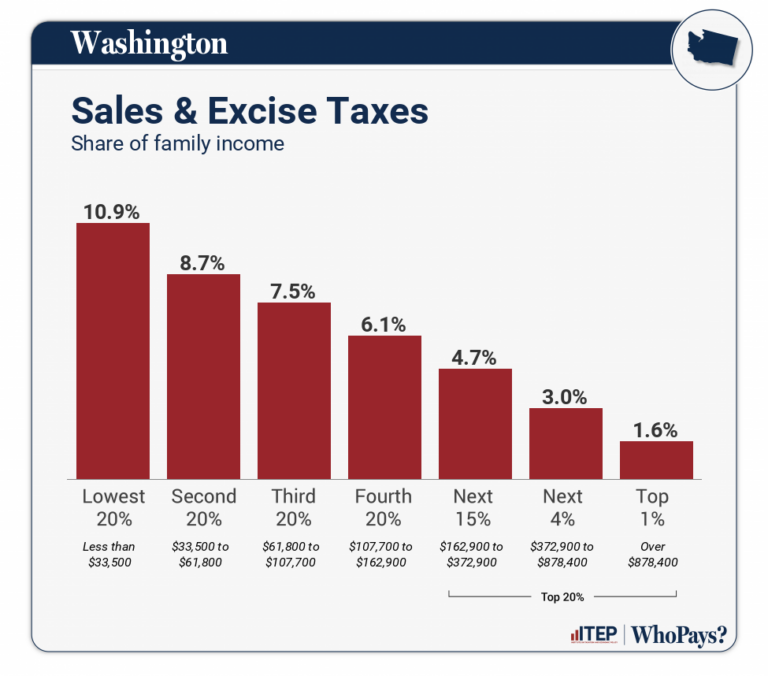

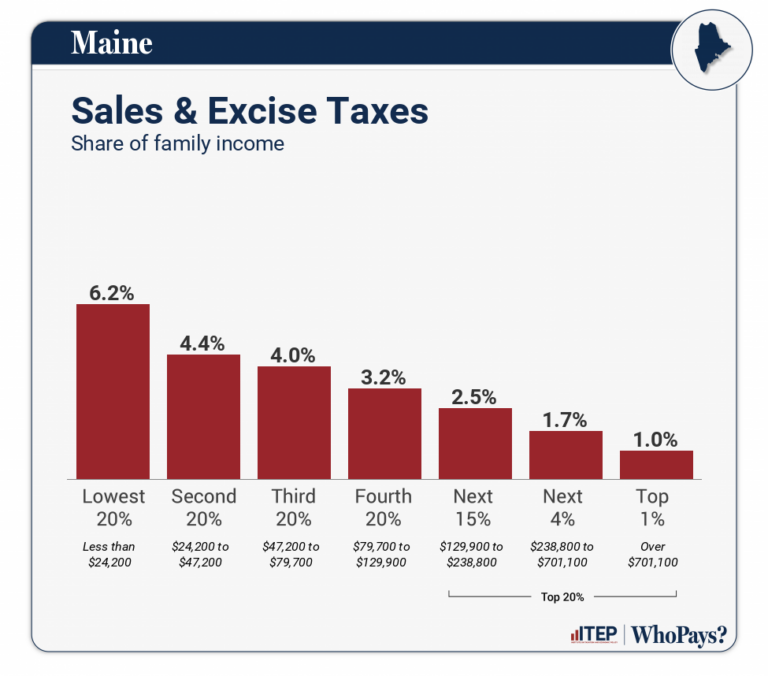

Taxing the things people buy has the most unfair impact on families with low income. Sales and excise taxes are also the most common way for states that have eliminated or flattened their income taxes to make up for lost revenue. For example, in Washington state, families with low income pay a portion of their income in sales taxes that is seven times higher than the wealthiest families, and almost twice as much as their counterparts in Maine.

What can be done to make tax structures fairer?

End corporate tax haven abuse with complete reporting. Worldwide combined reporting would require corporations and their subsidiaries to report global profits and pay taxes on the portion of their business done in Maine, leveling the playing field for local businesses paying taxes fairly.

Make corporations file state income tax disclosures. It’s impossible for state and local governments to know if corporations are paying their share because little to no reporting is required on the state level. Research by the Economic Policy Institute found that in seven states, 60% of corporations pay $0 in income taxes, including many with over $1 billion in federal taxable income. The Maine legislature passed a bill that would require Maine Revenue Service to report how many of the largest corporations doing business in Maine pay $0 in taxes.

Apply the federal corporate minimum tax on the state level. In 2023, the federal government enacted requirements that corporations with profits over $1 billion pay 15% of profits reported to shareholders. Also known as the “real profits tax”, it will prevent ultra-wealthy corporations from getting away with paying $0 in taxes. Aligning with federal policy will help prevent ultra-wealthy corporations from avoiding their obligations in Maine.

Reform or end wasteful corporate tax subsidies. Federal and state governments give away billions in taxpayer money to profitable corporations every year with little transparency or accountability built in. Corporations that receive subsidies often spend the money on stock buybacks and executive pay while their workers’ wages stagnate. Maine gives away over $1 billion in business tax breaks each year — almost as much as the state spends on education. Many of these subsidies are unproven or proven to be ineffective. States should implement subsidy guard rails like requiring sunset dates, income tax disclosures, and impact data, and by prohibiting stock buybacks and executive raises. Subsidies shown to be wasteful and ineffective should be scrapped.

Expose and prosecute ultra-wealthy tax evaders. The new IRS funding included in the Inflation Reduction Act will allow the agency to prioritize auditing and collecting from ultra-wealthy tax evaders like Microsoft, which owes $29 billion in back taxes resulting from avoidance schemes. Sustained funding and the resulting increased compliance will raise an estimated $851 billion over 10 years. Increasing funding will raise even more. Every $1 of IRS spending on audits of top earners delivers more than $12 of tax revenue.

Sunset income and estate tax breaks for the ultra-wealthy. In 2017, Congress passed a tax plan that primarily benefitted the wealthiest 5%, giving income tax cuts more than triple the value of those received by the bottom 60% of earners and doubling the amount the wealthiest households can pass on tax-free to their heirs. Allowing these provisions to sunset in 2025 will restore an estimated $400 billion in revenue per year. Maine’s estate tax excludes $6.8 million of inherited income from taxation, primarily benefiting the wealthiest Mainers.

Enact a mansion tax in the form of a progressive real estate transfer tax. Families with low and middle income are competing with more buyers than ever in a state where housing stock is limited, prices for homes are higher, and more homes are second homes or not owner occupied. Maine’s real estate transfer tax is assessed as $2.20 for every $500 in purchase price when property is sold. Creating a new transfer tax bracket for higher value real estate sales would ask more of those with higher wealth and provide new revenue to fund affordable housing solutions.

Enact a millionaire tax, raising income taxes on high earners. Maine’s current tax code requires middle class families to pay the same rates as millionaires. Creating a new bracket for those with higher income would add fairness. ITEP analysis estimates that adding a surcharge of 3% on income over $1 million and 6% on income over $10 million would isolate impact to the wealthiest 0.2% in Maine and would bring in an additional $99 million in revenue each year.

Restore and expand tax credits for families with low and middle income. Expansions of the federal Child Tax Credit, Earned Income Tax Credit, and tax credits for Affordable Care Act marketplace coverage in 2021 all contributed to a significant reduction in poverty and helped working families make ends meet, but were ultimately allowed to sunset. In recent years, Maine has expanded the dependent care tax credit, property tax fairness credit, and earned income tax credit, but there is more to be done to make the tax code fairer for all.

Did you know…?

- Since 2020, the world’s five richest men more than doubled their collective wealth to $869 billion. That’s a rate of $14 million per hour. Meanwhile, 4.8 billion people were poorer in 2020 than they were the year before.

- Over three decades, the net worth of the wealthiest 1% of Americans grew by $21 trillion, while that of the bottom 50% dropped by $900 billion. The bottom 50% of American households owns just 2% of the nation’s wealth.

- 35 major US corporations, including Tesla, T-Mobile, Ford, and Netflix, paid less in federal income taxes between 2018 and 2022 than they paid their top five executives, despite being profitable during that time period. While together those 35 corporations paid their executives $9.5 billion, their combined tax bill came to a negative $1.8 billion. Not only did they not pay their share, they were also rewarded with lucrative tax breaks.

- 75% of the super-rich support a 2% wealth tax on billionaires. More than half also agree that the concentration of extreme wealth is a threat to democracy.

- One year’s worth of uncollected taxes would have covered an extension of the expanded child tax credit through 2025. Or it would have paid for nearly all the non-defense discretionary spending of the federal government.

- In 2022, CEO pay was 344 times higher, on average, than the pay of a typical worker.

Dive deeper…

Taxes and Racial Equity: An Overview of State and Local Policy Impacts | ITEP

The Pitfalls of Flat Income Taxes | ITEP

State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms | ITEP

Washington Prepares for the ‘Super Bowl of Tax’ | The New York Times

Corporate Tax Avoidance in the First Five Years of the Trump Tax Law | ITEP

Tax Cuts and Jobs Act Expiration is a Chance for Tax Fairness to Flourish | MECEP

Top 1% Up $21 Trillion. Bottom 50% Down $900 Billion. | People’s Policy Project