Labor unions are a time-tested way for workers to organize and negotiate collectively for higher wages, better benefits, and safer working conditions.

By advocating for better conditions in their own workplaces, unions also set standards for workers throughout the country. While union membership has declined since the 1960s, unions are still key to building a stronger, fairer economy for working Americans.

Unions combat income inequality

All workers contribute to the economy and deserve a fair share of the benefit when the economy is growing.

Collective bargaining through labor unions helps create a fairer society. Unions ensure that a greater portion of a corporation’s profits go into employee’s paychecks, not into shareholder dividends. This ultimately means that ordinary Americans enjoy a larger share of economic growth when unions are stronger.

Over the course of decades, more and more of the wealth created in the United States has been captured by a small slice of the population. This growing inequality harms economic growth.

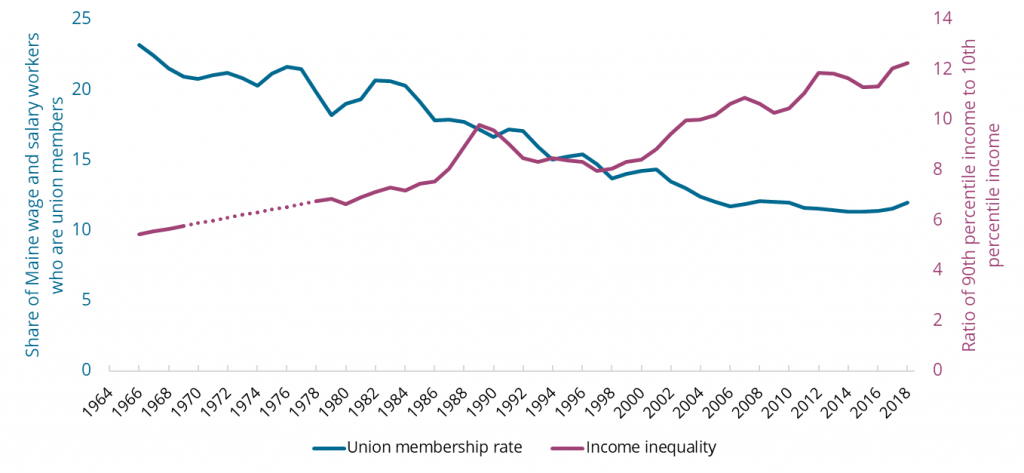

Research has shown that as union membership has declined in the United States, income inequality has grown. The lack of worker bargaining power has directly contributed to the growing gap between rich and poor. In the mid 1960s, one-quarter of private-sector workers were members of a union. Today, it’s half that rate.

A half century ago, when unions were at double their strength in our economy, the wealthy were still doing well: Back then, the highest earning 10 percent of households had five times the income of the bottom 10 percent. Today, with unions at reduced strength, the wealthiest households have 12 times the income of the poorest ones.

Low- and middle-income Americans drive the economy. With more disposable income, they fuel consumer spending — creating jobs and boosting overall growth. By contrast, as the economy tips further away from gains for families with low and moderate incomes, their purchasing power declines. This harm is compounded by the fact that the additional wealth accumulating to the top is more frequently diverted to investments, asset purchases, savings, or other ends that don’t do as much to create jobs or growth.

Unions boost wages and benefits

Negotiating wages and benefits for their members is a core function of labor unions. As a result, workers who are union members have higher wages and more robust benefits packages. In Maine, the median hourly wage for workers under a union agreement is $22.79, compared to $17.11 for non-union workers.[1]

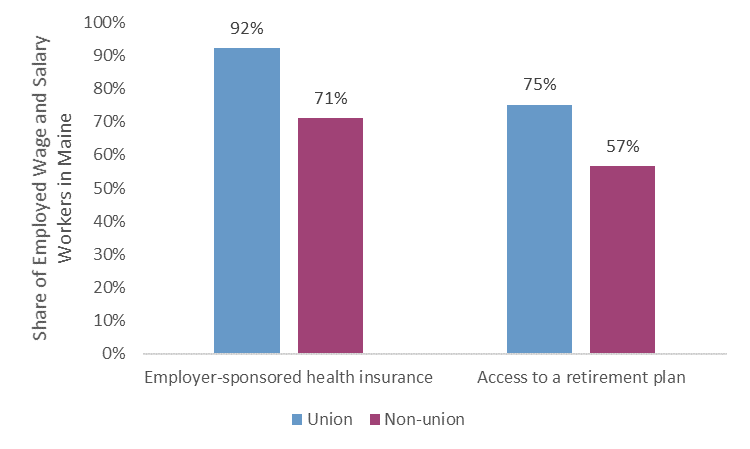

Maine workers who are members of a union or covered by a union contract are more likely than nonunion members to have access to a retirement plan and to be covered by health insurance.[2]

By negotiating for their own members, unions set industry standards for pay and benefits even at nonunion workplaces. In this way, unions’ strength is directly tied to working conditions throughout the economy. Research from the Economic Policy Institute shows that union decline has contributed to real wage loss for nonunion workers, especially among men and workers without a college credential.

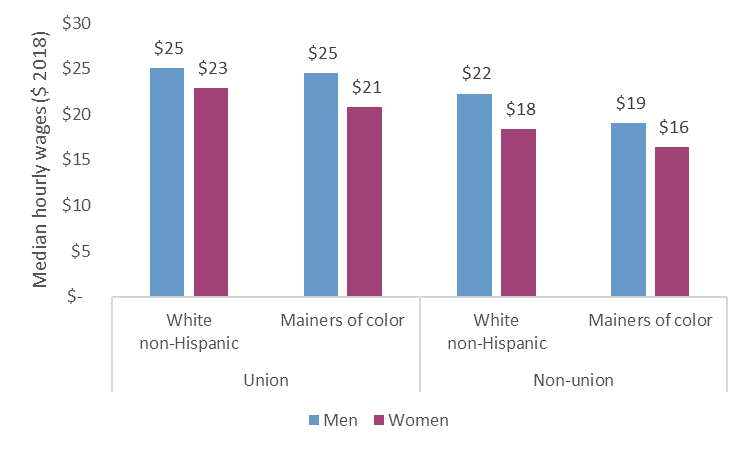

Unions reduce the wage gap for women and people of color

Disparities in wages along race and gender lines persist in the modern economy, where people of color — and women of color in particular — continue to earn less than white men. Union membership reduces the ability of employers to discriminate against individuals, and results in fairer wage levels than those produced by one-on-one negotiations. While collective bargaining does not erase wage disparities completely, it does help narrow the gap.

Conclusion

Mainers do better when workers are empowered to negotiate fair wages and working conditions with their employers. Salaries and benefits are higher for everyone, and inequalities are reduced. More money in workers’ paychecks means stronger economic growth, and a bigger share in the benefits of that growth.

As we commemorate Labor Day, we should remember the role unions have played in promoting a stronger, fairer economy for all.

Endnotes

[1] MECEP analysis of US Census Bureau, Current Population Survey, Outgoing Rotation Group microdata, 2016-2018 monthly pooled data via the Integrated Public Use Microdata System (IPUMS). Data adjusted for inflation to 2018 levels using the Consumer Price Index (CPI)

[2] MECEP analysis of US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, 2016-2018 via the Integrated Public Use Microdata System (IPUMS).