In Maine, most students do borrow for college. Sixty-three percent left school with debt in 2015, carrying an average debt load of $30,000. The debt load is even higher at Maine’s public universities. Despite the lower sticker cost of tuition, more than three-quarters (77%) of UMaine graduates have student loan debt, and the average debt burden is $33,000.

Good afternoon Senator Whittemore, Representative Lawrence, and members of the Joint Standing Committee on Insurance and Financial Services. My name is Jody Harris with the Maine Center for Economic Policy. I am here to testify in support of LD 1507, “An Act To Establish a Student Loan Bill of Rights To License and Regulate Student Loan Servicers.” The bill requires the licensing and oversight of student loan servicers to prevent them from cheating Maine consumers into delinquency or default.

You have heard the shocking news reports about exploding student loan debt. Some estimates put it at $1.3 trillion nationwide. Student loan debt is now second only to home mortgages. [1]

In Maine, most students do borrow for college. Sixty-three percent left school with debt in 2015, carrying an average debt load of $30,000.[2] The debt load is even higher at Maine’s public universities. Despite the lower sticker cost of tuition, more than three-quarters (77%) of UMaine graduates have student loan debt, and the average debt burden is $33,000.[3]

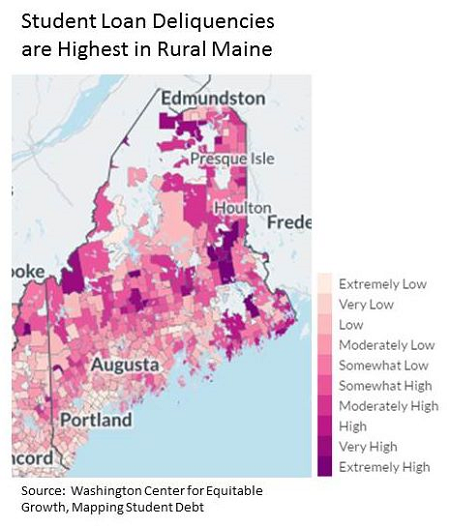

Unfortunately, Maine students are delinquent or defaulting on these loans as well. And as the chart below shows, students in rural Maine have the highest delinquency rates in the state.[4]

The reasons for delinquency or defaulting on loan payments are many. But student loan servicing abuses are a significant cause of defaults. In January, the Consumer Finance Protection Bureau (CFPB) sued Navient, the largest student loan servicer in the country, for deceiving customers to save costs. Among the abuses by Navient the CFPB alleges[5] are:

- Failing to tell students about income-based repayment plans so they can’t keep up with payments.

- Obscuring renewal deadlines for borrowers enrolled in income-based repayment plans causing the student to default.

- Handling payments incorrectly and refusing to correct them so students appear to be delinquent or in default when they have actually made the payment.

All of these predatory practices are driving Maine borrowers into default or delinquency and driving up costs and fees.

In their response to the CFPB’s complaints, Navient said, “The servicer acts in the lender’s interest…and there is no expectation that the servicer will ‘act in the interest of the consumer.'” This makes it abundantly clear that servicers have no intention of working with borrowers to get their loans paid off.

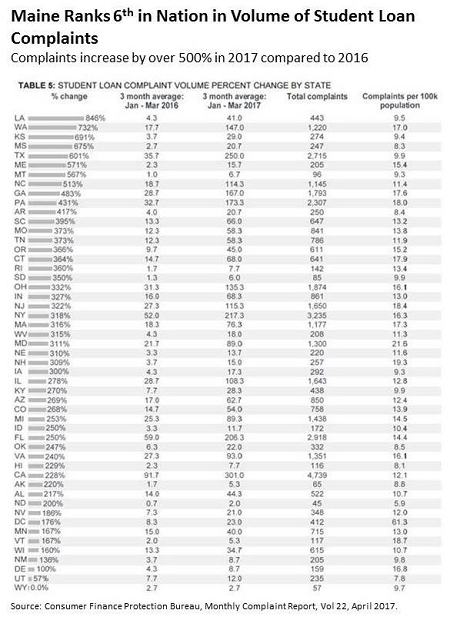

We have evidence that Maine consumers are struggling with these service companies. Maine ranks sixth in the nation in volume of student loan complaints to the federal CFPB with a whopping 571% increase in the first three months of 2017 compared to the same time frame last year. Complaints from Maine consumers to the federal bureau averaged nearly 16 per month in 2017.

It is all the more important now that Maine addresses this problem. Despite the CFPB having found significant abuses by servicers, the federal Department of Education has actually recently reversed consumer protections that had been passed by the previous administration.

Delinquency and default can have serious, long-term effects on borrowers. Not only does a default on a federal student loan harm a borrower’s credit score, but the federal government has extraordinary powers of collection. They can garnish not only a defaulted borrower’s tax return, but their Social Security payments.

I believe there is someone here today who will talk about the amount and impact of student loan debt carried by older Mainers. These Mainers co-signed loans to help their kids go to college and now are carrying that debt into retirement. For anyone living on Social Security, to have their benefit swept by loan companies when other options are available to them is contemptible.

It doesn’t have to be this way. Federal student loan borrowers can exercise an array of options ―from income driven re-payment plans to discharges for disability. Unfortunately, student loan servicers routinely fail to advise borrowers of these options―instead keeping their customers in high-cost payment plans and dooming them to economic hardship.

When the federal government fails to protect consumers, the state can act in the interest of its citizens. I urge your support of LD 1507, so Maine can help its student borrowers manage their debt successfully and protect them from abuses from the servicers who should be on their side.

Thank you. I am happy to answer any questions.

[1] https://www.bostonfed.org/publications/new-england-public-policy-center-research-report/2016/student-loan-debt-delinquency-and-default-a-new-england-perspective.aspx

[2] http://ticas.org/posd/map-state-data#overlay=posd/state_data/2016/me

[3] http://ticas.org/posd/map-state-data#overlay=posd/state_data/2016/me

[4] http://mappingstudentdebt.org/#/map-1-an-introduction

[5] https://www.consumerfinance.gov/about-us/newsroom/cfpb-sues-nations-largest-student-loan-company-navient-failing-borrowers-every-stage-repayment/

[pdf-embedder url=”https://www.mecep.org/wp-content/uploads/2017/05/LD-1507_student-loan-debt-abuse_05-10-17.pdf” title=”LD 1507_student loan debt abuse_05-10-17″]