With widening income inequality and rising cost of living, even Mainers who are working hard can find it difficult to make ends meet. Today, things got just a little bit easier.

Today, Governor Janet Mills signed into law LD 1671 — a bill that adjusts Maine’s tax code to boost economic security for low-income, working Mainers and closes a business tax loophole that gave multi-state corporations an unfair advantage over Maine-based businesses.

This bill is a great step toward un-rigging our state’s tax code which asks the poorest Mainers to pay more than the wealthiest households.

The new law will benefit more than 100,000 Maine households by more than doubling Maine’s Earned Income Tax Credit, starting in 2020. The EITC is a commonsense tax break that gives working people with low incomes a bigger refund when they file their taxes. The law will also allow childless, independent 18- to 24-year-old workers to receive the credit for the first time.

Spending by low-income households is crucial for our economy

The ability of working people to keep up with basic spending is essential for our state to truly prosper. When Mainers can reliably pay for transportation, food, housing, childcare, and other necessities, it’s easier for them to work, take care of their families, and be active participants in their communities.

Unfortunately, many Mainers struggle to make ends meet even when they are working hard,[i] and our out-of-balance tax code — which has made the poorest Mainers pay a larger share of their income in state and local taxes than the very wealthy[ii] — just makes matters worse.

The Maine EITC boosts incomes for hardworking Mainers with low-to-moderate incomes. That money goes right back into our communities and our economy. The EITC also helps make our tax code a little fairer, by giving more money to the families and individuals left behind by recent state and federal income tax cuts for the wealthy.

A long-overdue boost for working Mainers

Maine’s EITC is based on the successful federal Earned Income Tax Credit. Eligible households receive the federal EITC when they file federal income taxes and the Maine EITC on their state returns. For years, Maine’s EITC has been worth 5 percent of the federal credit, making ours one of the smallest EITCs in the country. It was long overdue for a boost.

LD 1671 increased the state EITC from 5 percent to 12 percent of the federal refund for families with children, bringing the maximum state credit from $328 a year up to $787. The new law also addresses a disparity that provided childless adults a disproportionately small federal credit by increasing the state match from 5 percent to 25 percent. For working, low-income adults without kids, that means a new maximum credit of $132, compared with the $26 maximum for which they were previously eligible.

LD 1671 also corrects another problem with the federal EITC. Young adults between the ages of 18 to 24 are ineligible for the federal credit if they don’t have children, even if they are independent of their parents, living on their own, and struggling to make ends meet. The EITC is meant to help low-income workers make ends meet, but these young workers were left out.

Roughly 86,000 households already qualify for the EITC in Maine. LD 1671 expands eligibility to include the previously excluded 18- to 24-year-olds, making about 16,000 low-income, childless young adults eligible for the first time.[iii

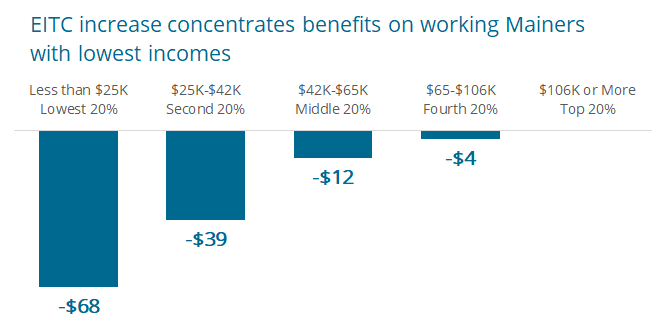

Average tax change by income quintile. Source: Institute on Taxation and Economic Policy, June 2019.

Closing tax loopholes for multi-state corporations, and putting that money to work for low-income workers

LD 1671 makes Maine’s tax code fairer on two fronts: The EITC expansion decreases the overall effective tax rate for Mainers with the lowest incomes, who today pay a higher share of their income to state and local taxes than the wealthiest.

At the same time, the law closes a loophole in the Maine Capital Investment Credit that gave greater benefits to multi-state businesses than it does to those that operate only in Maine.

Altogether, the tax changes in LD 1671 takes the revenue generated by closing the Maine Capital Investment Credit loophole and puts it right back into the pockets of working Mainers through the EITC.

Notes:

[i] Maine Center for Economic Policy. “Could you cover an unexpected $400 expense? Nearly half of Mainers could not” Available at: https://www.mecep.org/could-you-cover-an-unexpected-400-expense-nearly-half-of-mainers-could-not/

[ii] Maine Center for Economic Policy. “The Prosperity Budget.” Pg. 32. Available at: https://www.mecep.org/wp-content/uploads/2019/01/Prosperity-Budget-Booklet.pdf

[iii] Institute on Taxation and Economic Policy, June 2019.