The plan from Democratic legislators also increases investment in education and other critical services

Augusta, Maine (Wednesday, April 15, 2015) The Maine Center for Economic Policy (MECEP) today released “Distributional Analysis: ‘Better Deal’ Provides Bigger Tax Cuts for Most Mainers while Increasing Investment in Education and Other Critical Services,” a report prepared in association with the Institute on Taxation and Economic Policy, a nationally prominent non-profit, non-partisan research organization that works on federal, state, and local tax policy issues.

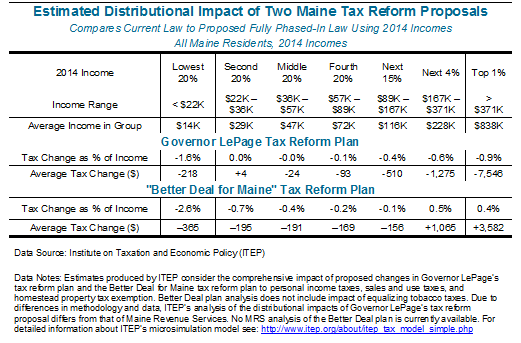

“The Better Deal for Maine plan would cut taxes, on average, for the bottom 95% of Maine taxpayers,” the analysis found. “The bottom line is that the Better Deal plan reduces taxes more than the governor’s plan for the vast majority of Maine families. And it does so without forcing future cuts to education, healthcare, and other critical services important to all Maine people and businesses.”

“Overall, the Better Deal plan would make Maine’s state and local tax system more progressive. In contrast to the governor’s plan, it does not increase sales tax rates above current levels,” the analysis adds. “It replaces the current individual income tax with a more progressive rate and bracket structure that retains the top marginal rate of 7.95% for individuals with income greater than $150,000 and families with income greater than $300,000. It provides more targeted property tax relief to Maine residents by doubling the homestead property tax exemption for all Mainers and increasing the size of the property tax fairness credit by the same amount the governor’s plan proposes. It would also adopt the governor’s plan for a refundable sales tax fairness credit to offset the impact of permanently higher sales tax rates and expansion of the sales tax to more goods and services.”

For a PDF version of the MECEP/ITEP analysis, click here