For a PDF of this document, click here.

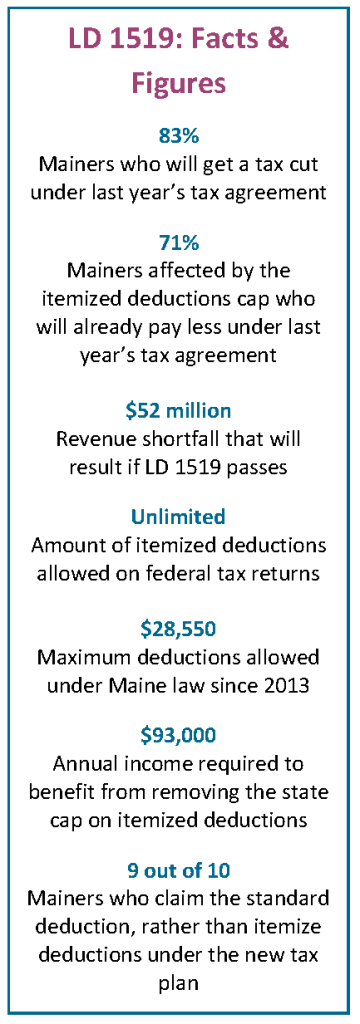

Last year, legislators came together to determine our state’s needs and craft a budget to meet them. This process resulted in a bi-partisan budget that funds our schools, our communities, and programs that help Mainers most in need. The budget also includes a new tax plan to pay for these important services and infrastructure that will help Maine people and businesses prosper now and in the future. Maine Revenue Services projects that the new tax plan will cut income taxes for 83 percent of all Mainers, double property tax relief, boost after tax income for low- and middle-income Mainers, and make overall state and local taxes fairer.

Concern over impacts on charitable contributions have prompted LD 1519, a bill to roll back important provisions of the tax plan. These efforts jeopardize funding to our schools and communities and overstate the tax plan’s impact on charitable giving. Allowing wealthy Mainers to deduct unlimited amounts of contributions from their taxable income will undermine the achievements of last year’s budget and compromise our capacity to meet the needs of our communities legislators outlined last year. Lawmakers should reject LD 1519 and retain the cap on itemized deductions.

Concern over impacts on charitable contributions have prompted LD 1519, a bill to roll back important provisions of the tax plan. These efforts jeopardize funding to our schools and communities and overstate the tax plan’s impact on charitable giving. Allowing wealthy Mainers to deduct unlimited amounts of contributions from their taxable income will undermine the achievements of last year’s budget and compromise our capacity to meet the needs of our communities legislators outlined last year. Lawmakers should reject LD 1519 and retain the cap on itemized deductions.

Here are five things you should know about LD 1519 and charitable giving:

1. Mainers already get a tax incentive for gifts to charity, and it doesn’t hurt Maine communities. Federal income tax law allows nearly all Mainers to deduct unlimited amounts of charitable contributions from their taxable income. This incentive is much more powerful than any incentive Maine could provide through state deductions because federal income tax rates, especially for wealthy Mainers, are much higher than state income tax rates.

2. Maine is not an outlier. Twenty-five states and D.C. do not allow unlimited charitable deductions. States across the country have limited or eliminated itemized deductions to make their budgeting process more predictable and sustainable. Data show that there is no significant difference in giving between states that allow itemized deductions and those that do not.

3. Most Mainers affected by the deductions cap will pay less income tax, meaning they can afford larger contributions. The Institute for Taxation and Economic Policy analysis estimates that 71% of people the cap affects will pay less in income taxes under the new tax package. This is because the tax plan also lowered income tax rates. Even without the ability to claim unlimited deductions, most Mainers—even those making large contributions—are already paying less in income taxes under the new plan, and can afford to make larger, not smaller, contributions.

4. Low- and middle-income Mainers will give more. The new tax plan lets low- and middle-income Mainers keep more of what they make. Even though this group usually receives no tax benefit for their contributions, they donate a larger percent of their income than higher income families. Increasing after tax income for these families means they can afford larger charitable contributions.

5. There will be minimal effects on Maine charitable giving. Opponents of the itemized deductions cap cite research that fails to account for interaction between limiting itemized deductions and significantly reducing income tax rates. Nearly all Mainers who itemize their deductions will be able to give more under the new tax plan.

LD 1519 will create a $52 million dollar revenue short fall that will likely be paid for by cuts to important services or by funds that state would better spend to improve Maine schools and communities. Last year’s tax plan already ensured that charitable individuals will still be able to give at their normal levels; now, lawmakers must reject LD 1519 to ensure that they keep the promises they made to Maine kids, families, and businesses.