Seniors, veterans, and all Maine families and individuals who are doing their best to get by in difficult times need fair and responsible resources that will truly help them over a hump. This bill would legalize a product that will do the opposite―line the pockets of predatory lenders with the precious dollars of those who have so little to spare. We urge you to reject this bill.

Good afternoon Senator Whittemore, Representative Lawrence, and members of the Joint Standing Committee on Insurance and Financial Services. My name is Garrett Martin and I am the executive director of the Maine Center for Economic Policy. Our organization uses its economic policy research and analysis to advance credible policy solutions that foster economic opportunity for Maine working families. I am here to testify in opposition to LD 1164, which would create a long-term loan with rates well in excess of 200% APR on loans as large as $2,000.

This type of debt trap lending, a high-interest cousin to payday loans, is known to be so harmful to financially struggling Americans that 15 states and the District of Columbia ban the practice by capping annual interest rates on consumer loans at 36% or less. Maine would do better by our citizens by cleaning up the predatory lending that does exist in our state than by opening it up to this type of harmful payday lending. This product will lure financially struggling borrowers who think they are getting a helping hand into a deep debt trap that is guaranteed to keep them entangled for months or years.

Based on the terms that LD 1164 would legalize, we offer two examples to show the unaffordability of these loans.

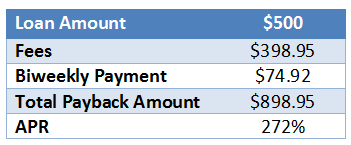

Let’s take a borrower who takes out a $500 loan and opts for biweekly payments, with the balance due in six months. The annual interest is 30%, and the lender is allowed to add an origination fee of 10% of the principal amount and a monthly maintenance fee of 15% of the average outstanding balance. Payments are due in roughly equal amounts.

This means the lender will collect well over one-and-a-half times what they lend – nearly $900 on a $500 loan, at an effective annual interest rate of 272%.

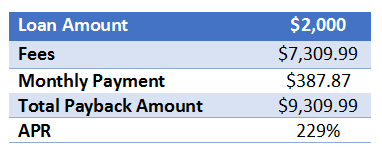

Next, consider the borrower who takes a $2,000 loan, due in 24 months, with monthly payments. The fees alone amount to $7,310, bringing the total payback amount to $9,310.

This is an outrageous product, targeted to folks who by definition have few resources to begin with. These loans have no effective underwriting. Unlike responsible lending, consideration of the borrower’s financial situation and the ability of the borrower to afford the loan is not assessed. In the type of loan legalized by LD 1164, the lender would have access to the borrower’s bank account to make automatic debits. This means that the lender will always get paid, even if the borrower falls behind on other bills, as long as there is money in their bank account.

We call this predatory lending, because this unaffordability and forced repayment leads to a debt trap—the borrower sees no other option than to re-borrow when they can’t pay off the loan for good―and it leads to overdraft fees, closed bank accounts, and even bankruptcies. This is not providing Mainers with access to credit. This is a corrupt business model, based on making loans to people who cannot afford them with terms that are unmanageable.

These lenders have a history of harming military service members, to the extent that the Department of Defense asked Congress to pass the 36% APR cap on consumer loans to active-duty military. The predators were clustering around military bases, impacting combat-readiness and morale of the troops. While the cap afforded some relief for active-duty members, veterans are not protected, and our state is home to many who are struggling to rebuild economic security. One in eight Mainers is a vet, and they deserve every fair and decent option we can provide for financial health and opportunity, not debt trap loans that will drag them down.

High-cost predatory lending is also a particular problem for seniors, who in Maine are more likely to be low-income than their counterparts across the United States.[1] Targeting older borrowers is especially egregious—they are so often reliant on a fixed income to cover basic living expenses, including medicines and other health needs. But they are unfortunately attractive to these lenders because they often have a steady source of income in the form of a social security check. In states that collect the data, Florida and California, seniors are the fastest growing population of payday loan borrowers.[2]

Seniors, veterans, and all Maine families and individuals who are doing their best to get by in difficult times need fair and responsible resources that will truly help them over a hump. This bill would legalize a product that will do the opposite―line the pockets of predatory lenders with the precious dollars of those who have so little to spare. We urge you to reject this bill.

Thank you. I am happy to answer any questions.

[1] Schaefer, Andrew and Mattingly, Marybeth J., A Portrait of Wellbeing: The Status of Seniors in Maine, Carsey School of Public Policy, University of New Hampshire, John T. Gorman Foundation, January 2016. Available at http://www.jtgfoundation.org/uploads/images/resources/Data_Book_Maine_Seniors_Count_JAN-22-16_FINAL.pdf

[2] “Seniors Fastest-Growing Segment of Payday Loan Borrowers, Senate Told,” David Morrison, Credit Union Times, July 25, 2013, http://www.cutimes.com/2013/07/25/seniors-fastest-growing-segment-of-payday-borrower.

[pdf-embedder url=”https://www.mecep.org/wp-content/uploads/2017/04/LD_1164_04-11-17FINAL.pdf”]