Like other states across the country, Maine’s constitution requires that the legislature balance the state budget every year, so any income tax cut must result in some combination of spending cuts or increases in other taxes. Both the experience in states that have cut income taxes in recent decades and independent academic research offer scant evidence that income tax cuts succeed in growing state economies.

For a PDF of this testimony, click here.

Good Afternoon Senator McCormick, Representative Goode, and members of Joint Standing Committee on Taxation. I’m Joel Johnson, an economist working at the Maine Center for Economic Policy. I’m here today to testify in opposition to LD 1367, A Resolution, Proposing an Amendment to the Constitution of Maine to Eliminate the Income Tax, legislation that would eliminate nearly half of the General Fund without recommending a package of spending cuts and/or increases in other taxes to make up the difference.

Like other states across the country, Maine’s constitution requires that the legislature balance the state budget every year, so any income tax cut must result in some combination of spending cuts or increases in other taxes. Both the experience in states that have cut income taxes in recent decades and independent academic research offer scant evidence that income tax cuts succeed in growing state economies.

Sales and property taxes are the other two major taxes in Maine’s state and local tax system and it would be impossible to reduce General Fund revenue by half by eliminating the income tax without raising sales and property taxes to make up at least some of the difference. For example, the Governor’s 2015 biennial budget proposal would raise more than $400 million in new sales tax revenue every year just to pay for the elimination of about one third of Maine’s income tax (plus estate and corporate income tax cuts). In addition, cities and towns must raise property taxes to make up for every dollar of essential (basic) K-12 education funding that the state cuts (or fails to pay for). So cuts to K-12 education result directly in property tax increases.

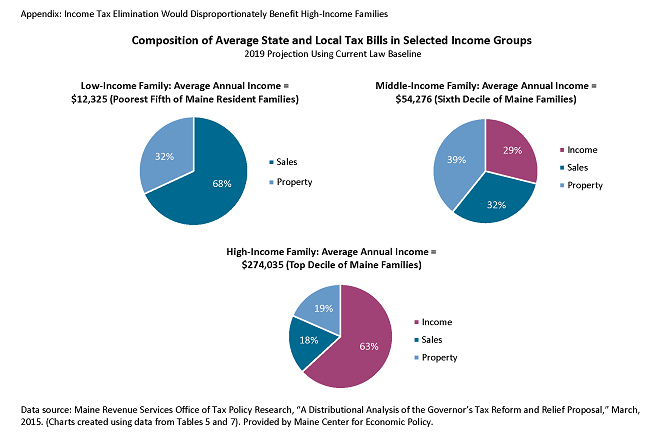

Since sales and property taxes have a disproportionately large impact on the household budgets of a large majority of Mainers, the bill before you today is a recipe for tax increases on low- and middle-income Mainers and very large tax cuts for a small, prosperous minority of Maine families.

To summarize, here are the five major reasons to oppose the elimination of Maine’s income tax:

- It’s a huge giveaway to the wealthy. The top 1% of Mainers – 7,000 households with incomes greater than $392,000 – will get a $61,000 income tax cut on average and account for 26% of the total amount. Meanwhile, middle-income Mainers – 140,000 households with incomes between $38,000 and $60,000 – will get a $900 income tax cut on average and account for less than 8% of the total.[1] Of course, the $900 income tax cut for middle-income Mainers will quickly disappear in the face of property and sales tax increases required to pay for eliminating Maine’s income tax. Instead of giving huge tax breaks to the wealthy and large corporations which eliminating Maine’s income tax will do, we should focus on fiscally responsible policies that deliver more value to the middle class.

- It jeopardizes funding for schools and other vital services. In 2019, the current income tax is expected to generate more than $1.7 billion in revenue.[2] That’s money we will use to pay for schools, provide access to health care for children, seniors, and people with disabilities, maintain public safety and critical infrastructure, and deliver other important services that Maine households and businesses want and need. Maine spends close to $1.2 billion on K-12 and higher education and $750 million on health care for children, seniors, and people with disabilities. Even if the governor cut all state funding for education and half the funding for health care, he still wouldn’t have enough money to cover the cost of eliminating Maine’s income tax. Rather than cut support for schools and other services, we should be calling on the wealthy and corporations to pay their fair share.

- It will trigger property tax increases. Reduced funding at the state level for schools and local services merely shifts costs to property taxpayers. This has already begun to happen. For low- and middle-income Mainers, increasing property taxes is a much greater concern than what they pay in income taxes. In addition, relying more on property taxes to fund schools and local services is a recipe for increasing inequality between wealthier and poorer parts of the state.

- It will make an unfair tax system even less fair. Low- and middle-income Mainers already pay more in state and local taxes per dollar earned than wealthy Mainers. Eliminating the income tax will worsen the situation, particularly as sales and property taxes increase to make up for lost income tax revenue. In fact, states with the least fair tax systems in the country are those that don’t have an income tax.[3]

- It’s a failed prescription for growing Maine’s economy. Real-world results in states that have enacted income tax cuts in recent decades and the academic literature lend little support for personal income tax cuts as a strategy for boosting Maine’s economy. Since Maine must balance its budget, the legislature must pay for tax cuts by cutting state services or raising other taxes. These actions will offset any benefits of the income tax cut and, even worse, may compromise Maine’s future prospects for growth. We can’t grow a strong economy when schools and workforce development programs are underfunded, vital communications and transportation infrastructure is absent or decaying, and lack of funding consistently undermines long-term efforts to improve health and protect the environment.

Thank you for your consideration and please do not hesitate to contact me with any questions.

1] Based on a projection of Maine’s current-law tax system in 2019 provided by the Maine Revenue Services Office of Tax Policy Research in “A Distributional Analysis of the Governor’s Tax Reform and Relief Proposal”

[2] Maine Revenue Forecast, May 2015

[3] Institute on Taxation and Economic Policy, “Who Pays? A Distributional Analysis of the Tax Systems in All 50 States,” January 2015.